This post is for you if you’re about to make your first investment (it doesn’t matter which type), or if you’ve just started trying your hand at investing (I’m glad I caught you in time

I get it.

You’ve finally understood investing is the way to go if you don’t want to work your ass to the end of time, if you want your money to make more money for you, and if you want to retire comfortably when it comes time.

More...

And you’re eager to start. And that’s all great!

But, surely you want to start off on the greatest note possible. Cool-headed, consistently invest more and more, and watch your net worth grow...

And I have a formula for you that consists of four actions that you should be doing, if you aren’t doing them already.

Treat them as the entry qualifications to the world of investing.

I promise you will have a much more stress-free experience, be able to make sound investment decisions, and - most importantly - make steady progress in increasing your net worth!

1. Getting Your Cash Flow into Its Best Shape

If you’re consistently spending less than what you’re making (AKA living within your means), congratulations - you have a healthy cash flow!

However, if the opposite is happening (you’re spending more than you make), hold your horses on that investment decision… we’ve got work to do first.

Your cash flow is one of the single most important areas of your financial life, yet it is also probably the most ignored.

A bad cash flow could mean you need to tighten your belt indefinitely due to an unexpected shortage of cash, or be forced to miss a credit card payment that will cost you a heavy penalty, or, equally horrible, you have to cash out your investment at a loss to cover your most basic needs.

In short, its consequences are nothing you’d want to put yourself and your family through.

Learn to take control of your cash flow by getting familiar with your numbers, prioritising needs over wants, and keeping yourself motivated with a few goals.

Know your numbers, it’s more important than you think.

What do the most successful savers, people and businesses have in common? They know their numbers and review them constantly.

Businesses do it quarterly, successful individuals do it even more often.

What can YOU do if you don’t already know YOUR numbers...

Simply start keeping track of your total expenses and subtracting it from your monthly income. If you have money left every month and you’re committed to stay that way, then you’re in a good place.

To take it a step further (like the pros do), set a budget, keep track of all your income and expense categories, and review them regularly.

Analyse & Optimise Your Cash Flow with the Help of a Licensed Financial Planner

Financially successful people have an incredible sense of where all their monies are. They invest, save, spend - make all their money decisions - based on that self-knowledge, and let that drive their next steps to achieve greater wealth.

They also prioritise saving and investing over spending.

Prioritise Needs Over Wants. It’s hard until it becomes easy.

Like all people, you are sometimes faced with choices you get to make between a need and a want.

You need a smartphone for work and not to live like a caveman. But you don’t want just any smartphone except that latest model you saw in the advertisement. It has that special function that will just make your life that much more better.

You have a 5-year-old car that still works. Sure, it doesn’t work like a dream anymore or the headlight design isn’t as charming as its latest model’s. You feel like you need to take the advantage of the current, rare Malaysian tax-free period. But truly, anything that covers beyond your actual needs belong in the “Wants” category.

The money you end up saving by not upgrading your car unnecessarily could grow into a cool RM50,000 when you retire (I assumed a one-time RM20,000 cost, 6.5% annual interest rate, 15 years till retirement in this example).

These decisions can happen occasionally for a big purchase. Or they happen daily, when you’re grocery shopping, buying lunch and choosing a weekend entertainment activity.

Even small sums add up. They deceptively look like they could be brushed off until you lump them together for a year, and dump them into an investment, and they grow and grow… until you have another cool RM21,000!

In this example, a one-time RM5,000, with 5% annual return, for 30 years -- grows into RM21,000.

Imagine if you put the same amount, RM5,000, into investment every year! You'll be a multimillionaire in the making!

Setting limits for yourself so that you don’t go overboard all the time is always difficult at first (I know that first-hand, my food bill used to be crazy high during a cafe-hopping craze in my life and a yearlong taste for fine-dining for every special occasion), UNTIL it becomes a non-thought and you’re just doing it out of habit.

Even if you’re among the high-income bracket in Malaysia (let’s say a monthly income of RM30,000 - RM50,000), the difference you can make by being mindful of your money could be between retiring at 60 years old from a job that sucks you dry - and - retiring fabulously young and energetic by 40 AND be able to do whatever you want for the rest of your life. Picture that, it will be worth it.

Don’t get me wrong. Notice I wrote not to go crazy *all the time* because, believe it or not, you can still enjoy (even indulge in!) life while you limit certain spending.

Maybe you like fancy holidays, so you skimp on weekday lunches or you opt for a budget airline over Qatar. Maybe your expensive hobby is a non-negotiable for you, so your haircuts are by a less senior hair stylist instead of the Chief Director...

Also, when something celebration-worthy happens?! Don’t hesitate to pop that champagne or splurge on a phenomenal gift for a loved one!

But keep a leash on yourself and come back to the safe side of the line after every splurge. Your goals will be leashes that keep you grounded and accountable.

Always have a goal (if not a few) that gets you excited!

You know what you want in life. You know what you’d love to be doing in 20, 30 or 40 years’ time.

This long-term goal is probably something that you need to finance (and upkeep) with your own money.

Take this grand vision and divvy them up into smaller milestones - and there you have your medium and short-term goals.

If it’s traveling the world, every new country could be a short-term goal; every continent a medium-term goal.

If it’s leaving a respectable legacy before you die, taking a public speaking class could be your short-term goal; building a business/brand you are proud of well into its 5th year could be the medium-term goal.

If it’s financial freedom that you’re after, perhaps your short term goal is to set up a side income/passive income stream; and your medium-term goal is to have RM500,000 in investments.

Whatever your case may be, take the time to set a few goals for yourself. They can be grander or simpler, or entirely different from my examples. Not everyone wants the same set of things.

As long as they’re truly important to you and align with what you want in life, they will work as the prizes on the horizon to keep you motivated to maintain a healthy balance with your money.

Key Takeaway

If you’re constantly over-budget with your cash flow, you leave no resources left to be put into places that actually matter: investment accounts, retirement savings or a future child’s education fund.

2. Securing Lifelines in Case of Accidents, Emergencies and Pure Bad Luck

Going into investments before having your ass/assets protected can be counterproductive.

How so? Let’s see.

You invest so that you’ll have more money, right?

While your investments are taking time to grow, you could lose your income, you could fall ill, you car could break down, a flood could cause damage to your house, an injury that prevents you from working for a few months could happen - life being unpredictable... can cause your finances to be jeopardised by any of these big hits or other life’s letdowns.

In this section I aim to help you understand the importance and how-to's of establishing “security measures” to protect some of the most critical elements of your personal finances.

You will have more confidence to walk in the uncertainties of life, if you knew you have identified and done the necessary to manage any potential risks that will impact your lifelines (e.g. your personal income, existing assets, basic needs).

In my personal opinion, you need these three strategies to be in place before you’re ready to actively invest:

Plan for medical emergencies

Did you know? High medical expenses have been listed as one of the contributing factors for debt problems and bankruptcies in Malaysia, according to AKPK.

A health emergency can create a financial catastrophe if you are not prepared.

And sometimes, for people who are responsible for the care of their elders, even a family member’s deteriorated health could result in misery, as in the case of Malaysia’s former fastest man who was declared bankrupt over a bank loan he took for his late father’s medical expenses.

Even if you are provided with medical insurance by your employer...

Take those company insurance documents (it could be a booklet with your name on it OR if your company provides an employment letter with the insurance benefits, that will do too) - take those documents to a financial adviser or your insurance agent, have him or her assess your needed amount of coverage based on:

- Your age

- Your health condition

- The up-to-date medical costs (current “market prices”)

- P.S. while you’re at it, just check if your plan has a co-insurance term (it’s bad, you don’t want it; it means you have to share medical costs too)

If the amount you are now covered for is not enough. What you can do is:

- Pay to top up the coverage of your existing company insurance (like topping up extra RM10 to an insufficient postpaid mobile plan someone gifted you)

OR - Purchase a separate plan for additional coverage that you need.

If you don’t have any professional to contact, send me your docs. I could take a look when I have free time on hand.

Most “group” plans, available for companies with 5 or more employees, only provide a minimum coverage.

Which means the maximum insurance payout may not be sufficient to cover your entire medical expenses.

Working in a smaller company may mean you have slightly higher coverage than the standard “group” plans (usually in this case, your company purchases insurance plans under your name, instead of the company name, hence you’ll have your policy booklet).

It may feel a little tedious to do this step (by the way, a top-up is likely cheaper than you thought)...

But you’ll be happy you did it if/when you are to claim your medical expenses in full.

Protect your income in case of temporary disability

A breadwinner of a household holds heavy responsibilities of being able to work continuously to provide income for a family.

In case of accidental injuries where you could be temporarily disabled (e.g. accidental injuries causing you to be unable to report for work for, let’s say, 9 months), how do you secure a “just-in-case” income source to make sure you and your family will eat and have electricity?

If you weren’t aware of your SOCSO benefits: Social Security Organisation (SOCSO) does provide disability benefits for Malaysian employees who are employed under a contract of service. However, the compensation only ranges from RM30 to RM105.33 per day.

More details of your SOCSO benefits here.

In this day and age, I reckon SOCSO’s coverage isn’t going to be sufficient for you, especially if you also have a house and car to pay for.

If you’re convinced you need additional coverage to withstand such events, get a disability insurance from an insurance provider. They are usually very affordable (a decent coverage for RM20-30 per month).

A Personal Accident (PA) insurance, for instance, provides weekly benefits, for up to 52 weeks (with most insurance providers), if you become temporarily unable to work due to an accident.

Provide securities for your home

Homes, one of the things we feel naturally protective about.

Protective because we know, in the long years we own them as our assets, they stand in the face of all kinds of risks, such as fire, lightning damages, flooding and burglary.

Also, because any risks that are home-related generally scream “expensive”!

Isn’t it scary to think about having to pay out of your own pockets to repair for house damages or, worse, to replace the loss of your home?

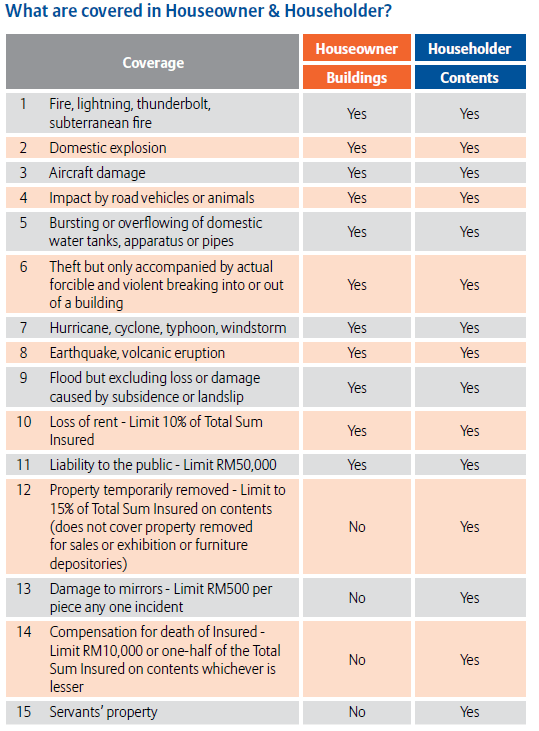

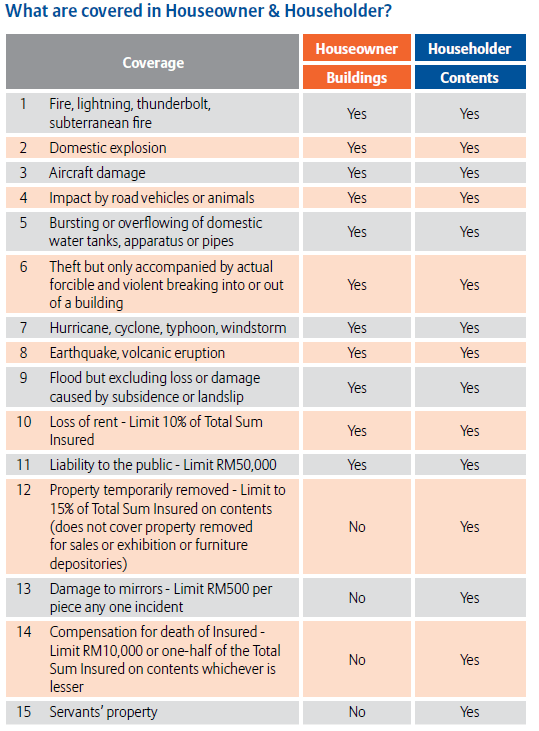

Before we have to get too dark about losing piles of cash, get yourself a Houseowner & Householder Insurance.

Normally a Houseowner & Householder Insurance covers a list of these risks. Some companies may leave out or add on a few other line items. Compare a few quotations before purchasing.

The amount of coverage you should go for should be adequate enough to secure your pocket in the case of any eligible accidents.

It also doesn’t hurt that the insurance cost can be very reasonable (as low as RM45 a month for a standard RM500,000 house).

An additional tip from a financial adviser, create a home inventory of all your receipts (and photos) of your home-related purchases so that if you ever have to file for a claim, your case holds irrefutable evidences and will be processed quickly.

While not all life’s risks can be eliminated or accounted for entirely, they, in large part, can certainly be minimised and controlled with these three strategies mentioned.

Key Takeaway

Without protection on your income and assets, of course you can still start to invest and make profits, but you risk paying for accidents, emergencies and terrible luck with those profits.

3. Clearing Short-Term, High-Interest Debts

Would you be happy to pay RM1,150 for anything with an asking price of RM1,000?

Of course not. You weren’t even happy to pay the RM1k for it in the first place!

Yet, more than 50% of credit card holders are essentially overpaying, by approximately 15%, for everything they purchased on credit but didn’t settle payment for.

If you have any outstanding payment to be made still on your credit card, settle it before you move on to start an investment.

The logic is simple: you will never make the ROI back that you lose from having to pay a credit card’s very common interest rate at 15-18%.

Personal loans generally have lower interest rates, but it doesn’t mean you shouldn’t go the extra mile to end the cycle of being in a bad debt.

If you have money to settle a personal loan early (check your early settlement T&Cs to avoid penalty fees), use a personal loan settlement calculator to work out how much savings you can make by doing so.

A bad debt causes you more harm than good

Immediately, once you miss a payment on a bad debt (and even a good debt), your credit scores take a hit.

Credit scores seem unimportant until they suddenly become important.

And when they suddenly become important, but they’re horrible, it will take you A LOT of work to get them looking good again.

Like when you’ve been owing credit card debt (or a good debt example could be PTPTN), then you decide that you want to get a house. So you need to get yourself a housing loan but the banker won’t approve your case because your debt servicing history is so terrible...

The length that you’d have to go to fork out a substantial amount of cash to settle your due amount in full, in a short time. The hassle of having to take days off to be at some centre or bank. The hectic chasing after bankers and officers to meet a deadline that comes with a penalty if you don’t meet it in time...

Again, do yourself a favour and save yourself the additional cortisol (stress hormone).

A high time for some discipline

When it comes to managing any personal finance matter, you will always need a little self discipline.

Instill in yourself tougher discipline when you need to pay off a credit card debt or personal loan, because this is the time you need it the most.

Once you’re clear, commit to staying out of them for good!

When you think about it, bad debts are actually easy to avoid. Make careful choices. Face your truth and ask yourself if you can afford what you want. Does the product in question bring you real, beneficial value or has good investment qualities?

Delayed gratifications can do you a world of good and make you appreciate an item or experience even more than if you decided to get it right away.

Key Takeaway

So much money is wasted on interest charges every year when they are completely avoidable. I can’t stress enough how clearing them asap can set you off for bigger, sooner financial success!

4. Prioritising Savings Over Expenses

Before you begin to contribute a sum to investments every month, you must have some savings on hand!

Build an Emergency fund

Having a safety net in the form of cash within easy reach is critical for your peace of mind.

If you have been treading life without any rainy-day cash, you will recognise what I’m about to describe... The constant worry about anything and everything that could go wrong, as you spend each day waiting for the next inflow of salary, commission or allowance.

Spare yourself the unnecessary distress.

Slowly save up for an emergency fund that you can tap into for any unforeseeable circumstance, but replenish it as soon as you can to its full amount!

My recommended amount is 6-9 months of your monthly expenses.

Now, ideally, this fund should be tucked away somewhere you can instantaneously access/withdraw money from.

A few great places to set aside your emergency fund:

- A savings account

- Fixed deposit (even if you withdraw before maturity, there isn’t a penalty fee)

- A full-flexi housing loan account

However, general recommendation like this can leave a lot of room for underutilised funds for high-expenses people/households.

Monthly Expenses | Months | Emergency Fund |

|---|---|---|

RM3,000 | x 9 | RM27,000 |

RM5,000 | x 9 | RM45,000 |

RM7,000 | x 9 | RM63,000 |

RM10,000 | x 9 | A whopping RM90,000! |

Can you see how certain demographics might have too much money hanging around as “lazy money”? The excess money is better off somewhere that can generate you a return (even if it’s a small return, don't forget compounding interests are powerful!).

So how do you know if your emergency fund is too large? We all carry different level of risks with our various lifestyles. For instance, you may live in a safer neighbourhood than I do, I may have a less expensive car that doesn’t cost much to repair, the next person might have a very unstable job… you get where I’m going with this?

If the potential cost of the biggest emergency that you can imagine (that requires instant cash) is far lower than the sum of your 6-9 months’ worth of emergency fund, don’t be afraid to put away 50% of it in a low-risk, still relatively accessible investment account.

For example, a low-risk mutual fund that you can withdraw money from in just 3 business days - still a quick turnaround time if you face a bigger emergency, like a sudden need to move house.

Don't forget about other savings goals!

Besides your emergency fund, you can simultaneously save for a few other goals (especially if you’re almost there with the full sum of the former).

Again, like I mentioned in the very beginning, goals that excite you are excellent at keeping you motivated. Hence, in order to keep saving diligently and to not give up halfway, set some savings goals.

Something I do personally: I name my savings account with a goal and it has always worked wondrous for me. Name it exactly what you are saving for, a few examples could be, "Year End Holiday", "New Camera Lens", "Baby Nursery Reno"... Check if you can do that in your online banking portal!

Typically my goals always include a trip of some sort. Somehow I am willing to forgo tiny pleasures in life when I can anticipate visiting somewhere new with my wife.

So, start writing down a few items or goals that are important to you to start saving up for. In general they could be:

Priming your mindset for FAST savings

A common mistake you might make when you’re trying to figure out how much of your income you should spare for savings is to approach it like this:

INCOME - EXPENSES = SAVINGS

Warren Buffett, the frugal billionaire, advocates to “not save what is left after spending; instead spend what is left after saving.”

INCOME - SAVINGS

= EXPENSES

In other words, prioritise your savings over expenses.

Whenever you receive your paycheck, immediately move away an optimal amount as savings, then only work out how your different expenses can be allocated for.

Automation is your friend here. Set up automatic transfers for your savings to be relocated to another savings account that you don’t normally do any transfers out of (e.g. withdraw or make payments).

If you adopt this mindset and practise the right priority, I guarantee you’ll be happy to see your results in just a few months.

Monitor your savings and investment accounts

Witnessing your road to financial success can be a sweet, sweet experience.

A very disciplined client of mine once recounted to me how she had become obsessed with checking the numbers in her savings and investment accounts. And how that kept her going.

The simple action of tracking and just being aware of how much money she has saved up and how much they’ve grown - give her tremendous motivation to stay on track with her savings and expenses.

From a financial adviser’s perspective, other than to gain motivation, keeping an eye on your numbers also means you’re more likely to notice when to make adjustments to your investments whenever you notice something is not growing as healthily as you’d like.

Key Takeaway

The habit of saving regularly is fundamental to a less stressful, more enlightened personal financial journey. It sounds like work, until you automatically become an advocate because you’ll stay motivated, year after year, to grow your net worth through successful investing.

Conclusion: Aim to Invest for the Long Term!

As a financial adviser, I have been encouraging my clients to invest with an important long-term vision in mind. For most people, the endgame is usually to sustain a post-retirement life with so much passive income that they will finally live on their own terms, doing what they love.

For many, that will begin past 60; and for a lucky few at 45 -- depending on how well they’ve been planning their finances and how efficient they've been at investing their income.

Think you need help with sorting the basics before getting into investing? Book my time to discuss and look over your current cash flow and net worth with the button below.

Analyse & Optimise Your Cash Flow with the Help of a Licensed Financial Planner

Which one of these must-do's before investing is the most particularly hard for you to accomplish? And why? Is it a lack of motivation or due to some other reason?

Share your thoughts in the comments section, I'd love to hear them!

Feel free to also comment below with any questions that I might be able to help you with as a financial adviser, and I will do my best to get back to you with answers or feedback.