Customised financial planning services to take care of your financial well-being.

I take you from A to Z in your financial journey. My advice is independent and unbiased. Committed to helping you make the most of your resources, let me show you how you can live your best life, free from anxiety about money.

Core Topics of Holistic Financial Planning

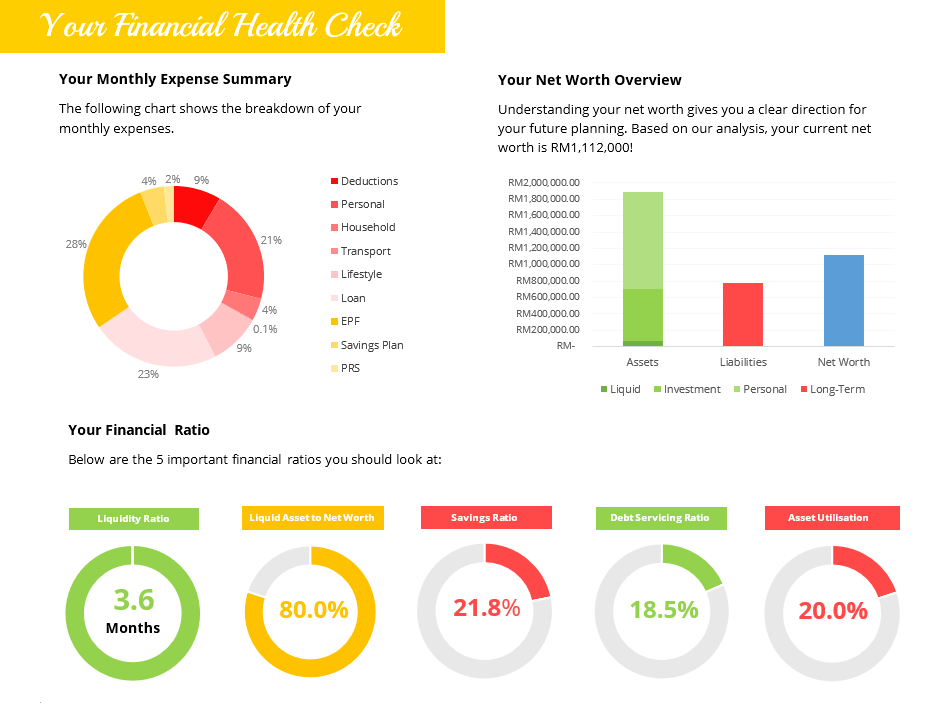

Financial Health Check

Like any self-improvement initiative, the very first thing you need before trying to straighten out your finances is to identify exactly where you stand, financially. Clarity will inform our strategies down the line.

Similar to a medical report with a summary of your blood sugar level, cholesterol and so on - a Financial Health Check gives you a thorough review of all your current finances. The results will be documented in a custom report for you (typically 15-20 page long).

They will include your cash flow summary, net worth, several important financial ratios, and actionable advice by a licensed CERTIFIED FINANCIAL PLANNER® that will be presented and discussed face-to-face with you.

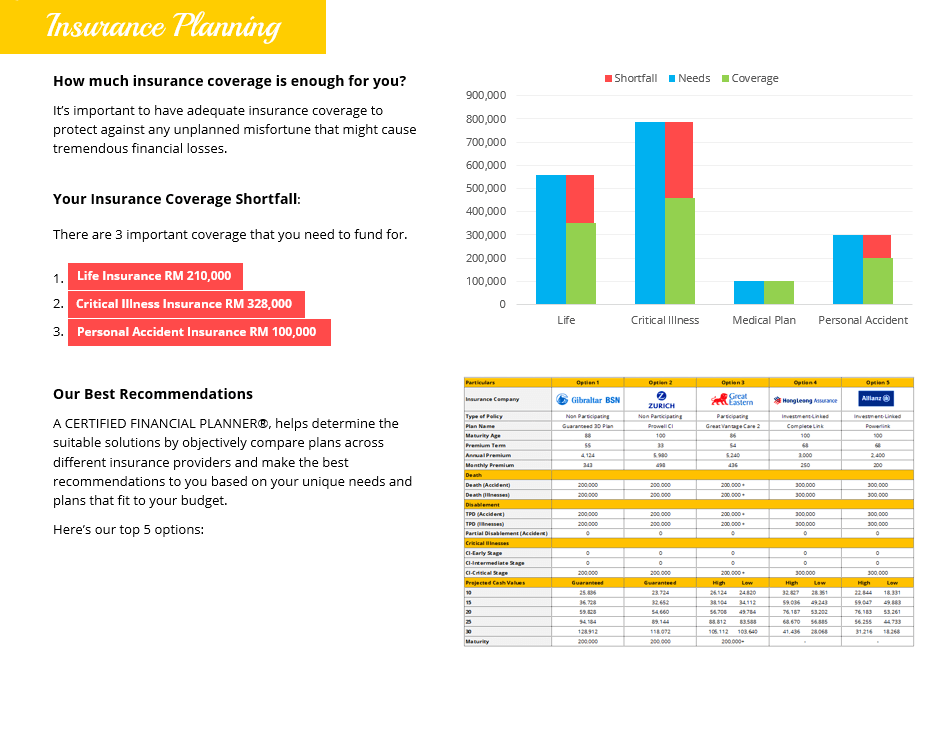

Insurance Planning

Being either under-insured or over-insured is never a smart way to use your money.

A CERTIFIED FINANCIAL PLANNER® helps determine if you even have a need for a certain type of insurance, to cut off or take up a policy, compare policies across different brands/insurance providers, and make a recommendation to you that is based on your unique needs that we have discussed.

If you already have insurances in place, and are in the midst of reviewing them (which you should do in every one or two years), engage a financial planner's help to ensure you are neither vulnerable to an unplanned misfortune nor paying more than you need to.

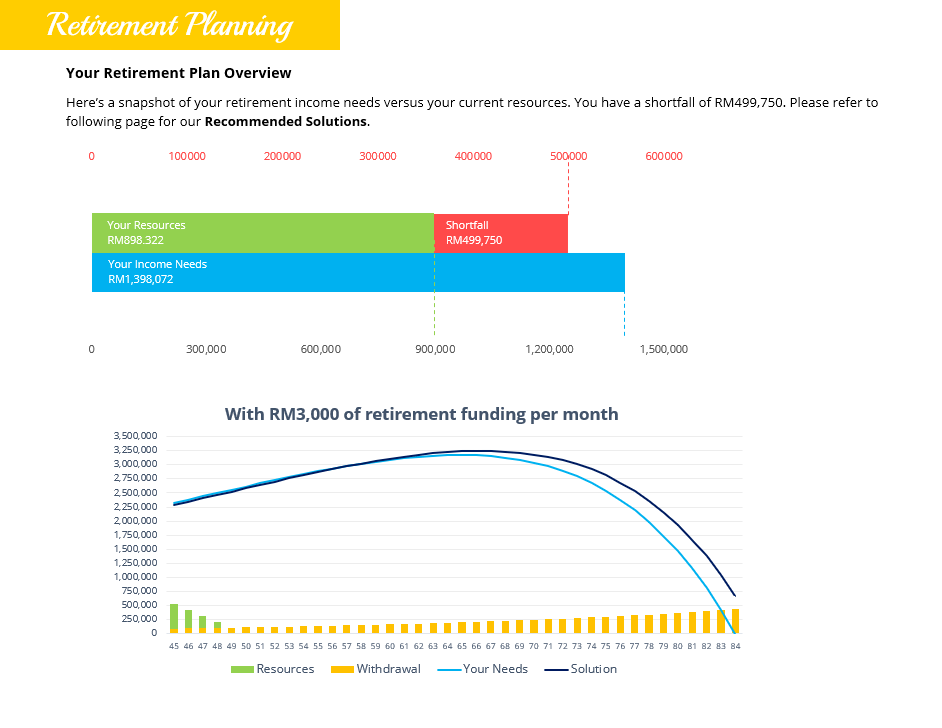

Retirement Planning

Retirement, in its traditional sense that is attached to idleness, no longer appeals to my clients. If you are like them, it is about finally having the time and capacity to do what you love and have always wanted to do.

I help you plan for the retirement of your dreams. And I make sure you stay on track to enjoy your exciting Golden Years. The ultimate goal is having enough money to fund for your entire retirement.

The retirement capital that you need will often depend on when you start contributing to it, your retirement lifestyle expectations, beating the inflation rate and more - work with a CERTIFIED FINANCIAL PLANNER® to get personal and get started in implementing the work.

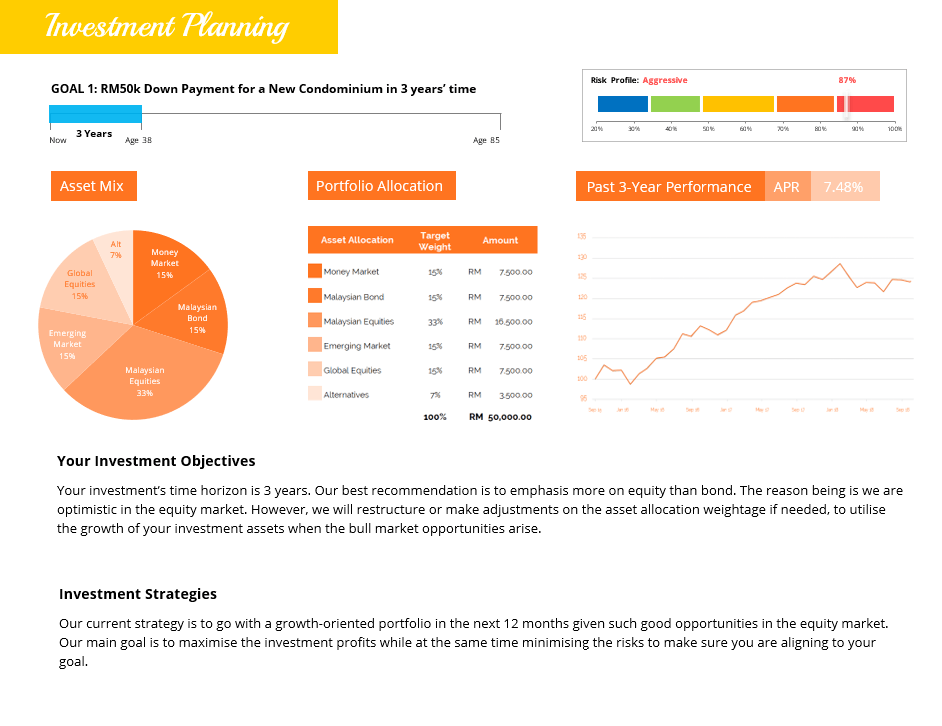

Investment Planning

I help you develop investment strategies appropriate to your unique set of goals, and advise you on an investment program that fits your risk appetite, yet will grow at a rate you desire in the long term.

If you have existing investments, let me help you reach a balance between the different asset classes. Learning the ideal balance suited to your goals and risk tolerance is going to make investing that much more fun and stress-free for you.

Leverage a CERTIFIED FINANCIAL PLANNER®'s insights and access to information that is often exclusive, to help you achieve your financial dreams.

Children's Education Planning

Your children’s education can single-handedly become the most expensive payments you make in your life.

With tertiary education fee increasing at an average of 6-8% a year, along with the effect of inflation - planning early for your pride and joy's future will give them the best opportunities possible to succeed in life.

I will provide solutions to your children's education funding. Help ensure your children can pursue the education of their choice at an institute of their dreams.

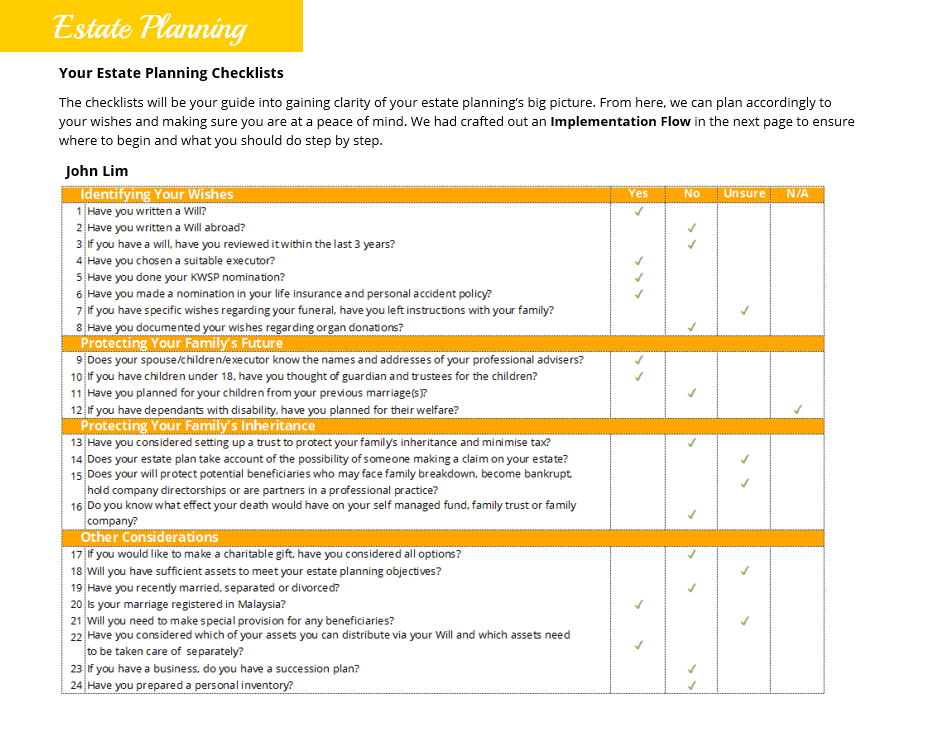

Estate Planning

Your estates are everything you own, such as your savings, cars, investments, insurances, collectibles and the like.

When it's time, you want to leave your legacy the way you intend to, and to people you intend for. Have a plan in place for your assets to be managed the way you want for when you're gone. Gift your most loved ones the resources they need to thrive after.

I can help you develop a cost-effective and efficient estate plan so that your estates will be distributed according to your wishes.

I make it easy for you to begin a journey towards better financial health.