I hope this article helps you out with medical card shopping for your child!

If you want to save time and just get me to match you with 1–2 medical cards that best suit your child's needs, click here.

There are close to 20 choices available if you are looking to get your child a medical card in Malaysia.

If you want to find out:

- Top 5 medical cards on the market for children right now

- 3 most important riders to include in your plan

- 1 way to quickly determine the BEST plan for your child

- Getting education savings with the medical card—good or bad idea?

- Lots more

Then you'll love this guide.

The info here works for ALL parents of young children in Malaysia (newborns, toddlers, preschoolers, primary school kids and teenagers).

So feel free to share this article with your fellow parent friends? 😉

First, let's get any confusion out of the way.

You may have heard people call it a "baby insurance" or a "child insurance"...

To be accurate, what they actually refer to is a medical card, or a medical plan, or a medical insurance for children.

Some even use the term "health insurance for children".

And yes, all these terms can be used interchangeably.

However, it is more precise to mention that what you're looking for is an insurance for a child's hospitalisation costs.

How does a medical card for babies work?

A medical card for your child works just the same as a medical card for any adult.

That is, if your child ever needs to be hospitalised, the bills can be taken care of by an insurance company.

A medical insurance like this can be incredibly helpful for times when your child needs to stay in a hospital for being

- seriously ill,

- injured in an accident at home or outside,

- and when he or she needs any minor or major surgery.

With a medical card for your baby, you may A) pay first then claim at a non panel hospital or B) get your child admitted to a panel hospital without paying anything (cashless admission).

How and when the insurance company pays for your hospital bills depends on whether you are visiting one of their panel hospitals:

A) If you visit a non panel hospital, you will need to pay first then claim the costs from the insurer.

OR,

B) If you visit a panel hospital, you won't need to pay out-of-pocket first. You will be entitled to a so-called "cashless admission" to the hospital.

Are you currently pregnant?

To look for a suitable insurance for you and your unborn baby, read this instead.

When is my child eligible to apply?

As soon as he or she reaches 14 days after birth, you can start applying for a medical insurance for your baby!

So if getting this insurance approved and in effect ASAP is important to you?

Make it a point to have a decision and the documents for application ready by then.

A good Licensed Financial Planner or agent will be able to assist you with this process, and help get your application approved in the shortest time possible.

When can premature babies apply?

It's not uncommon to see insurers postpone a premature baby's medical card application to when the child is 1 year old...

Sometimes even 2 years old!

Regardless, get in touch with an experienced licensed financial planner sooner than later.

Because what we can typically help our clients do is:

- Get 3-4 insurance companies to look at your case

- See what they have to say about whether they are happy to look at your application now,

- And if not, then we'd find out how long before they are willing to look at your application again.

If your premature baby manages to catch up to a healthy BMI of a full-term baby, there is something else that we can help you with as well.

And that is to appeal for an earlier re-application.

So that your child can get insured asap.

Again, a good Licensed Financial Planner or agent should be able to provide you with advice around re-application timing and assist you with the actual appeal process.

Can babies with congenital conditions apply?

Even if your child was born with a congenital condition, it does not mean you can't get him or her a medical insurance.

However, usually what happens in these cases is:

Either the monthly insurance premium will cost more.

(Around 30% more than the usual premium, in my experience.)

OR, the child's medical plan will exclude certain related coverages.

For example, a medical card for a baby born with a congenital heart defect will exclude any heart-related treatment, surgery and hospitalisation.

Otherwise the baby shall be covered for everything else that the medical card offers.

Of course, it's not ideal to have these extra terms and conditions but it is better than living life without a medical card at all, fearful of the "what ifs".

These potential problems—coverage exclusions and higher premiums (and the delays for premature babies)—are some of the main reasons to consider getting a baby insured during pregnancy.

How many insurance companies in Malaysia offer medical cards for children?

A medical insurance is the most basic must-have insurance for most people.

As a result, every insurance company has a medical card available for children (and adults).

Which means currently there are more than a dozen for you to navigate and choose from...

To be exact, there are 14!

- AIA

- Allianz

- AmMetLife

- AXA Affin*

- Etiqa

- FWD

- Great Eastern

- Hong Leong Assurance

- Manulife

- MCIS Life

- Prudential

- Sun Life*

- Tokio Marine

- Zurich

Note: *We at SimplyBetterFinances represent all the above insurers except AXA Affin and Sun Life. If you're a Muslim considering Takaful products as well, you have even more choices.

I assume nobody would have the time nor the desire to consider all 14 insurances.

So as a Licensed Financial Planner (LFP) who mainly works with young families of busy professionals, I have shortlisted top five insurers that serve most young families well.

How do the top 5 brands compare?

In terms of financial strength, reputation, accessibility, product and service quality...

The 5 insurers and their medical cards you'll see below are some of the best on the market right now.

They're also the ones my colleagues and I quote and recommend the most.

In alphabetical order, company name followed by their medical rider name and their investment-linked base plan name, these are the top 5:

- AIA

A Plus Health 2

under A-Life Joy Xtra - Allianz

HealthInsured

under UltimateLink - Great Eastern

SmartMedic Shield

under SmartProtect Junior - Hong Leong Assurance

Medishield III

under HLA CompleteCover - Prudential

PruMillion Med 2.0

under PRUwith you

- AIA | A-Plus Health 2 | A-Life Joy Xtra

- Allianz | HealthInsured | UltimateLink

- Great Eastern | SmartMedic Shield | SmartProtect Junior

- Hong Leong Assurance | Medishield III | HLA CompleteCover

- Prudential | PruMillion Med 2.0 | PRUwith you

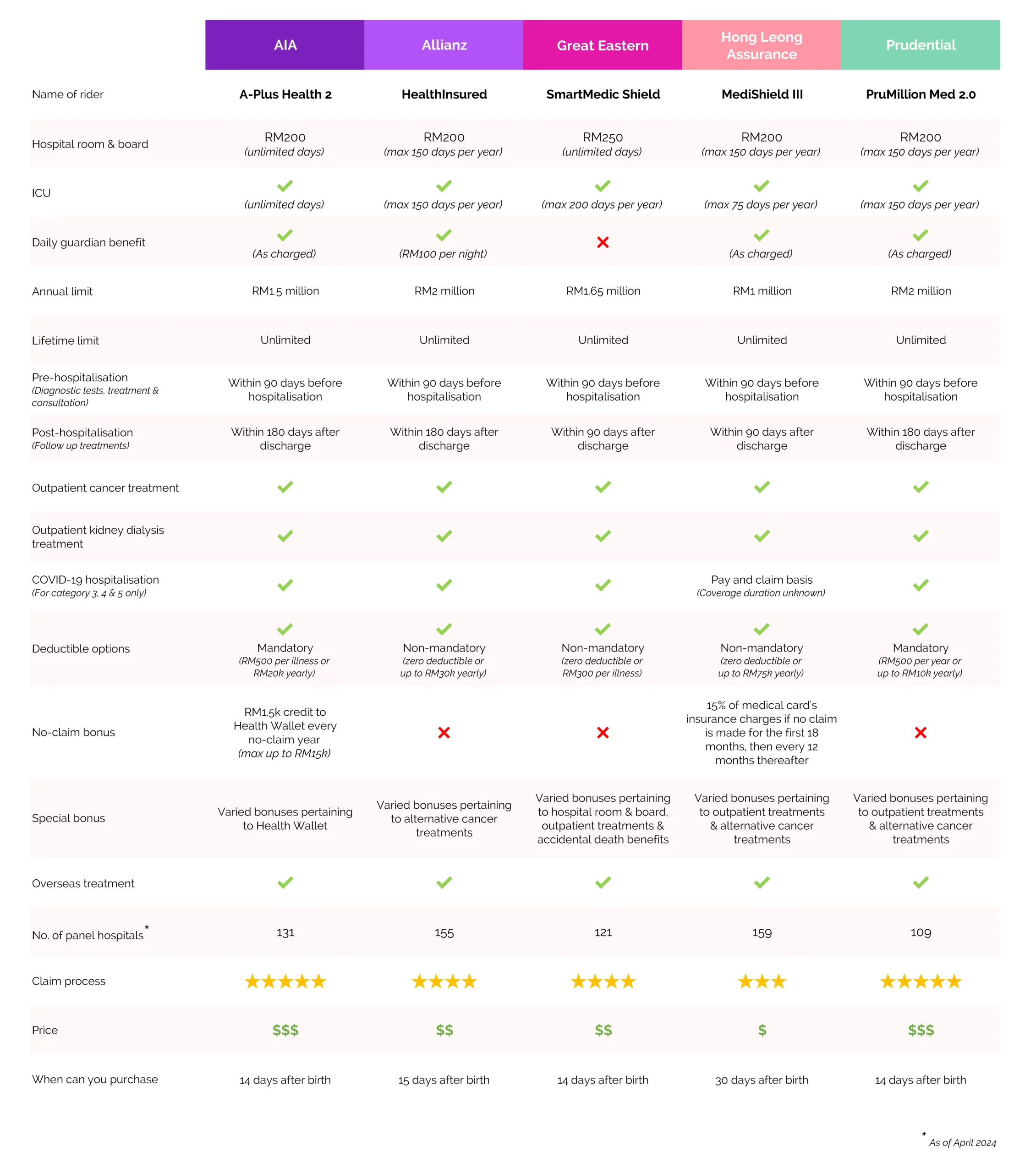

Now, let's compare 5 of them with hospital room & board benefit fixed at RM200 (or closest to RM200).

Meaning when hospitalised, your child can get a RM200 per night hospital room, which will usually afford you a 2-bedded room.

For more privacy, you can always top up around RM20-50 per night on your own to get a single room.

AIA | Allianz | Great Eastern | Hong Leong Assurance | Prudential | |

|---|---|---|---|---|---|

Name of rider | A-Plus Health 2 | HealthInsured | SmartMedic Shield | MediShield III | PruMillion Med 2.0 |

Room & board | RM200 (unlimited days) | RM200 (max 150 days per year) | RM250 (unlimited days) | RM200 (max 150 days per year) | RM200 (max 150 days per year) |

ICU | (unlimited days) | (max 150 days per year) | (max 200 days per year) | (max 75 days per year) | (max 150 days per year) |

Daily guardian benefit | (As charged) | (RM100 per night) | (RM100 per night) | (As charged) | |

Annual limit | RM1.5 million | RM2 million | RM1.65 million | RM1 million | RM2 million |

Lifetime limit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

Pre-hospitalisation (Diagnostic tests, treatment & consultation) | Within 90 days before hospitalisation | Within 90 days before hospitalisation | Within 90 days before hospitalisation | Within 90 days before hospitalisation | Within 90 days before hospitalisation |

Post-hospitalisation (Follow up treatments) | Within 180 days after discharge | Within 180 days after discharge | Within 90 days after discharge | Within 90 days after discharge | Within 180 days after discharge |

Outpatient cancer treatment | |||||

Outpatient kidney dialysis treatment | |||||

COVID-19 hospitalisation (For category 3, 4 & 5) | Pay & claim basis (Coverage duration unknown) | ||||

Deductible options | Mandatory (RM500 per illness or | Non-mandatory (zero deductible or | Non-mandatory (zero deductible or | Non-mandatory (zero deductible or | Mandatory (RM500 yearly or |

No-claim bonus | RM1.5k credit to (max up to RM15k) | 15% of medical card's insurance charges if no claim is made for the first 18 months, then every 12 months thereafter | |||

Special bonus | Varied bonuses pertaining to Health Wallet | Varied bonuses pertaining to alternative cancer treatments | Varied bonuses pertaining to hospital room & board, outpatient treatments & accidental death benefits | Varied bonuses pertaining to outpatient treatments | Varied bonuses pertaining to outpatient treatments & alternative cancer treatments |

Overseas treatment | |||||

No. of panel hospitals | |||||

Claim process | |||||

Price | $$$ | $$ | $$ | $ | $$$ |

When can you purchase | 14 days after birth | 15 days after birth | 14 days after birth | 30 days after birth | 14 days after birth |

As you can notice, each insurance plan above clearly has places where it shines.

Yet, none is perfect without any weakness!

So, the BIG question remains—

Which medical card should you choose for your child?

In theory it's simple, really.

Just choose a plan that fits both your family needs and ideal budget the MOST.

But in practice how do you do exactly that?

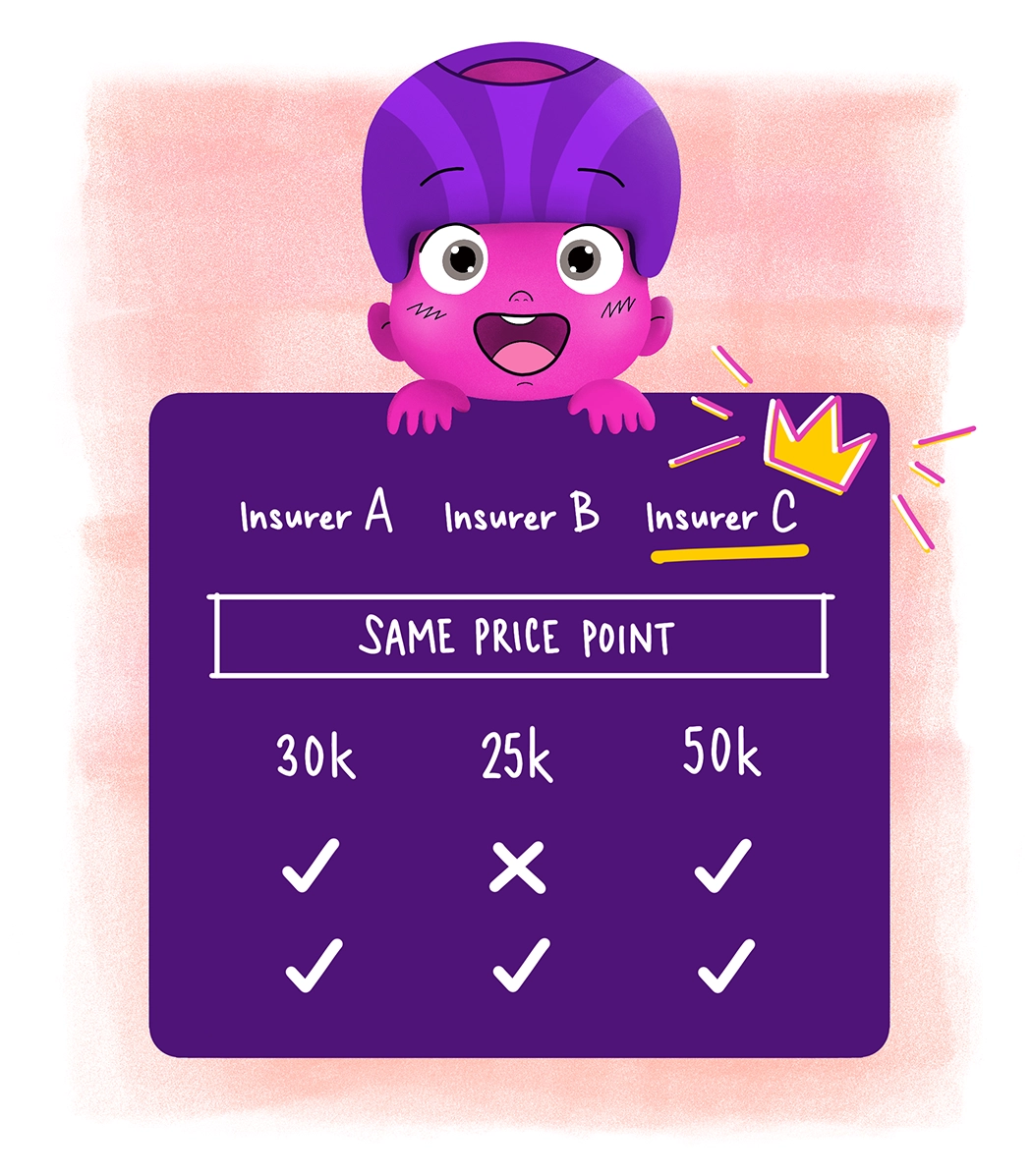

Well, the conventional way is—if you're interested in 3 different plans then you need to talk to 3 different agents from the respective insurance companies.

Ever done this before? Trying to decipher "quotations" in different formats and comparing plans with different variables through texts, emails and perhaps even on pieces of paper.

Obviously, doing it this way is pretty time consuming.

Secondly, it will quickly become mind-boggling when different agents send you quotations based on VERY different packages.

And most critically, it might not lead you to the right decision after all...

Since you're not talking to someone who is well versed in ALL the different insurance plans... across every insurance company...

(and knows each product's shortcomings like the back of their hand)

AND how the benefits of their riders compare against each other's.

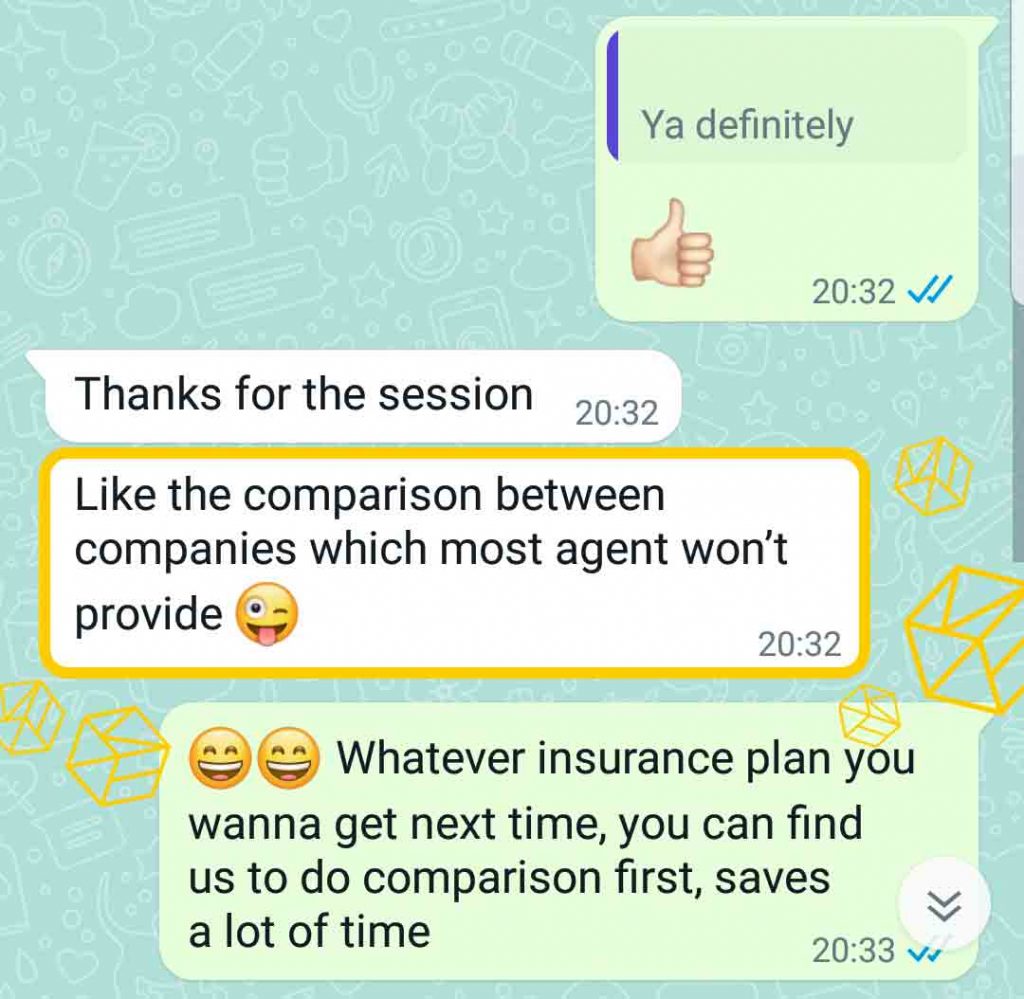

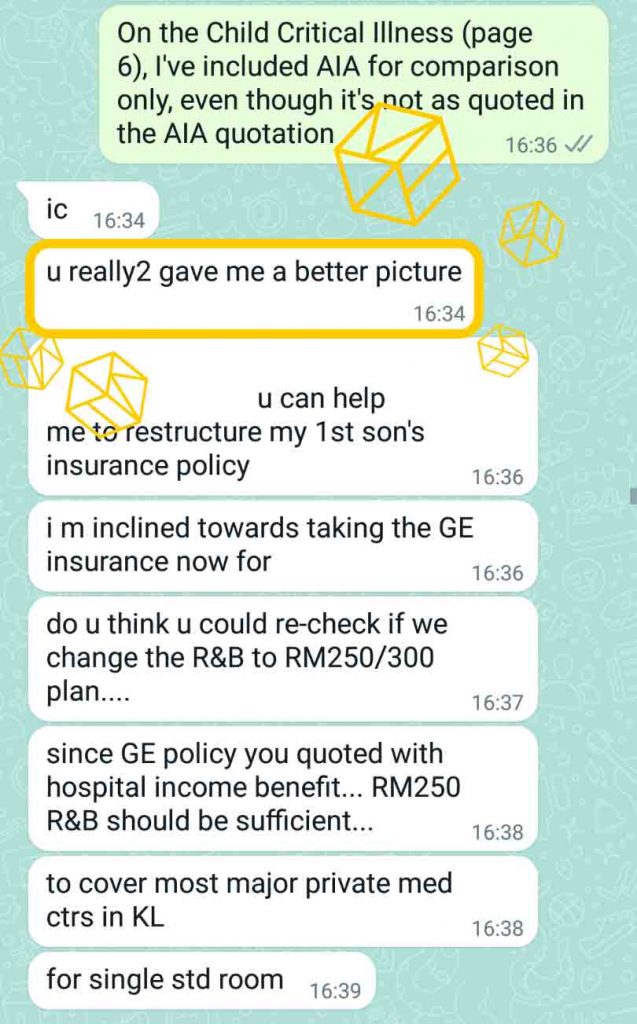

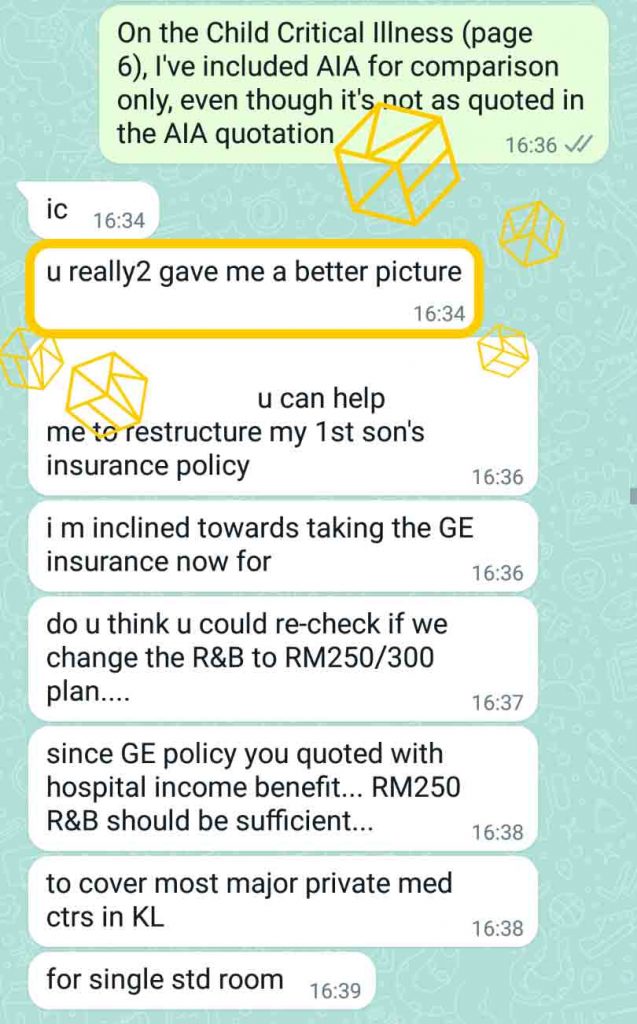

Licensed financial planners make it easy for you! At one glance you'll be able to quickly and clearly "see" which plan is your best fit.

The more guaranteed way that saves you precious time is—through an LFP.

We take you through a detailed, easy-to-understand comparison of 2-3 medical plans customised for YOUR child and your ideal budget.

With consultation on your family priority and guidance for every step of the way, too.

This way,

I have helped compare

quotations in

the last 2 years!

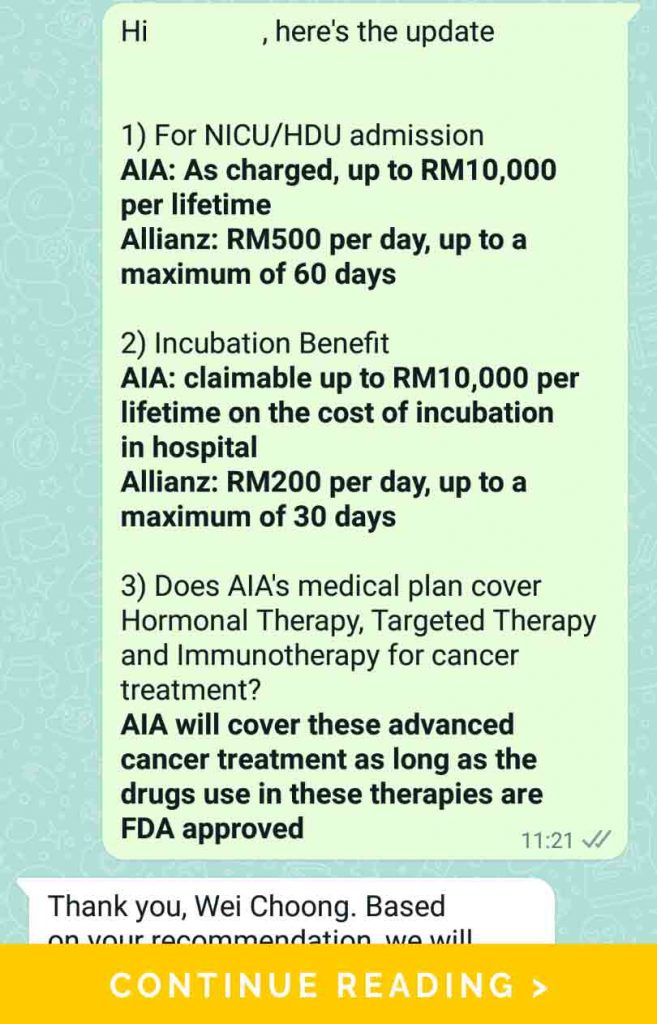

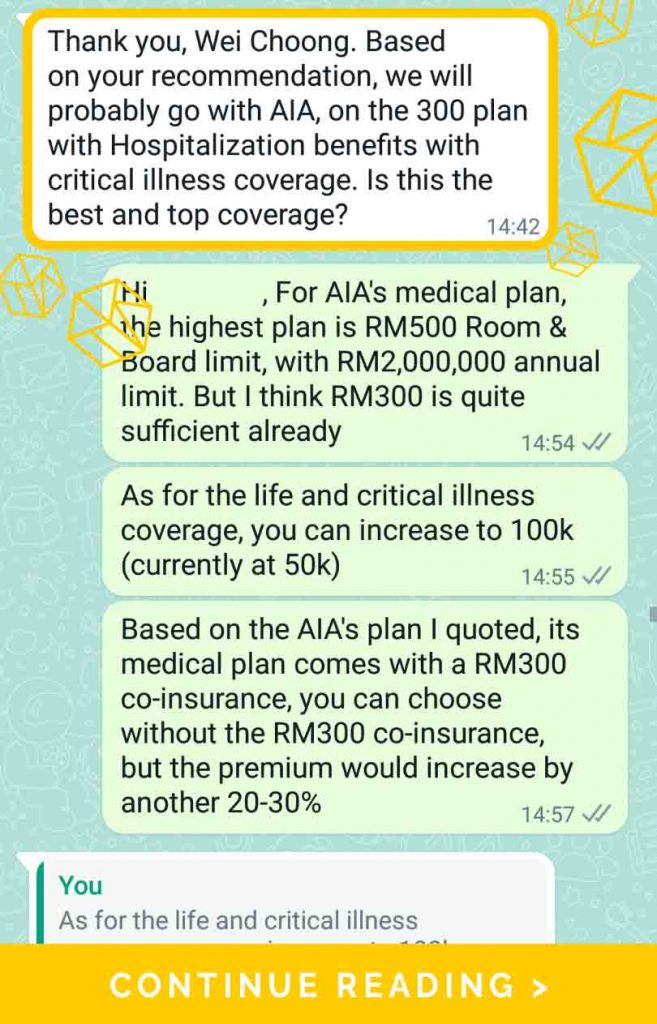

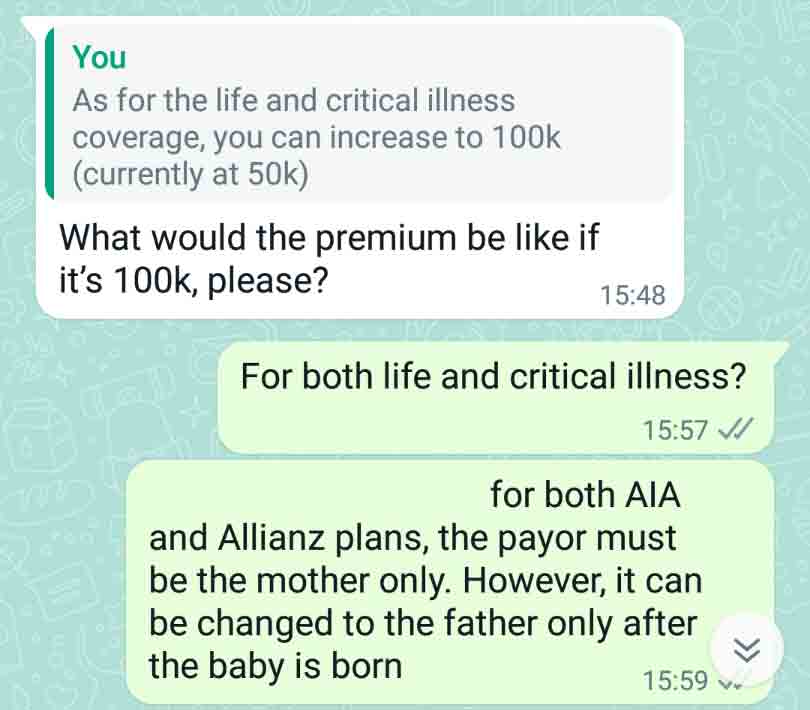

WHAT MY CLIENTS SAY

I helped compare

quotations in 2021!

WHAT MY CLIENTS SAY

Let me help you too

Book my time for a FREE

child insurance consultation

Get your no-obligation, FREE expert consultation. I will take you through the best, most suitable medical cards for YOUR child that the entire market has to offer right now. This is the new and improved way to source an insurance—smart, fuss-free and ultra efficient.

Book my time for a free consultation

No-obligation, FREE expert consultation. Easily find the best, most suitable medical card for YOUR child.

as Easy as 1, 2, 3

1. Complete the questionnaire above

What you submit is info we will need to make your quotations and a personalised report.

2. Book a time

Make sure you book a time for your online appointment with our licensed expert.

3. Be on time for your best insurance experience yet

You're now in great hands of a team who cares a great deal.

See you soon!

From here onwards let's dive deeper.

We will get into the more technical aspects of a child's medical insurance.

If you'll continue reading to learn more about the topic, I'm so glad you're ready to geek out with me!

What are the most important riders to consider?

Riders are add-on features that you can get to enhance your insurance plan.

To get a medical card without the important riders is like wearing an armor and then not equipping yourself with a shield and a sword!

More often than not, there are tons of riders that you can get with your insurance.

Some riders are absolutely essential.

Some are suitable only for a certain group of people.

The rest do not provide significant enough benefits, in my opinion.

With that said, there are a few staples that I almost always recommend.

There are other riders that I would suggest to my clients based on their lifestyle needs and individual requirements, but these staples make the first considerations.

If you want a customised consultation though, talking to a professional personally is still the most beneficial way to find out exactly which riders will protect your family best.

1

Essential rider

Premium waivers

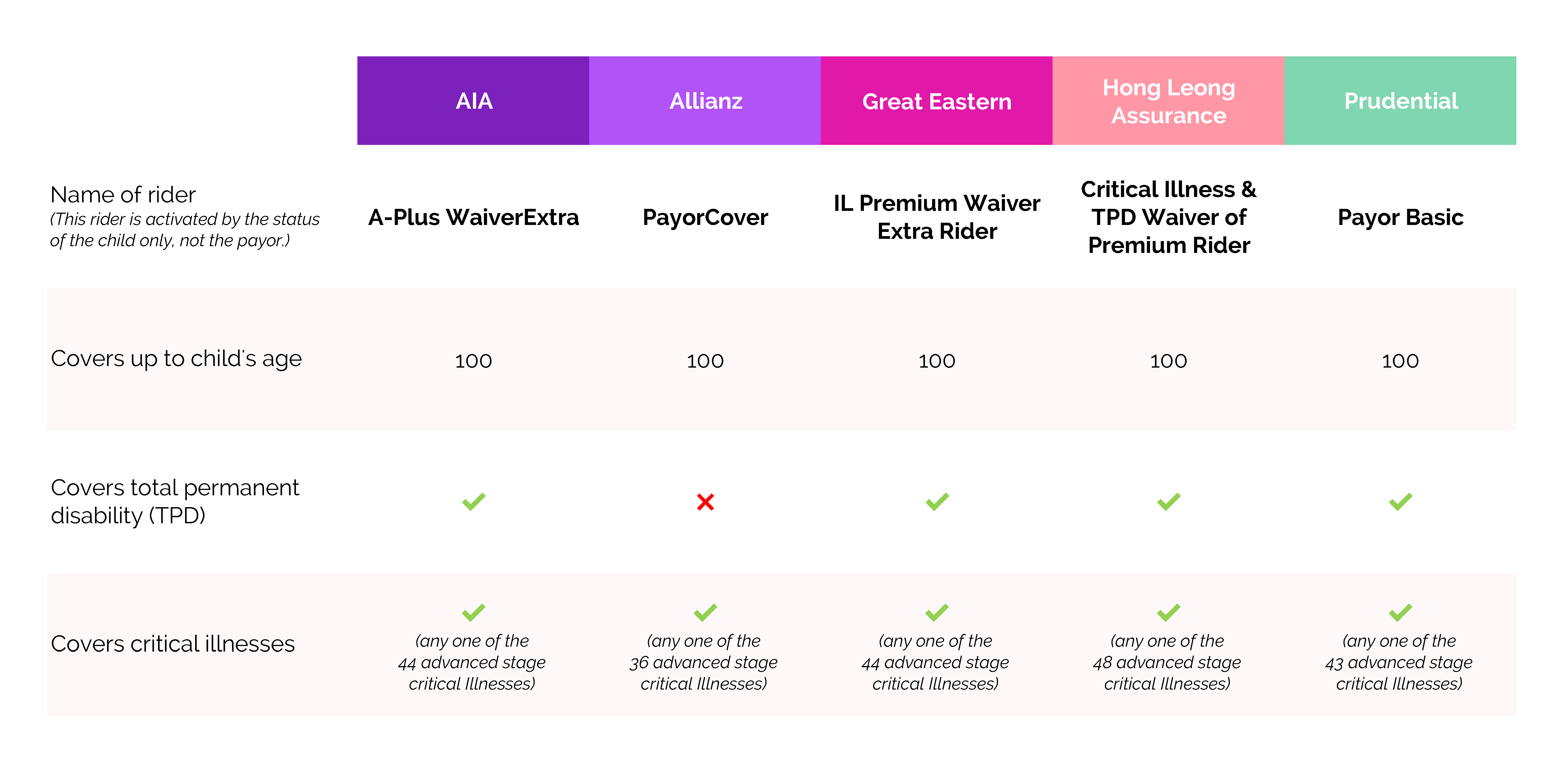

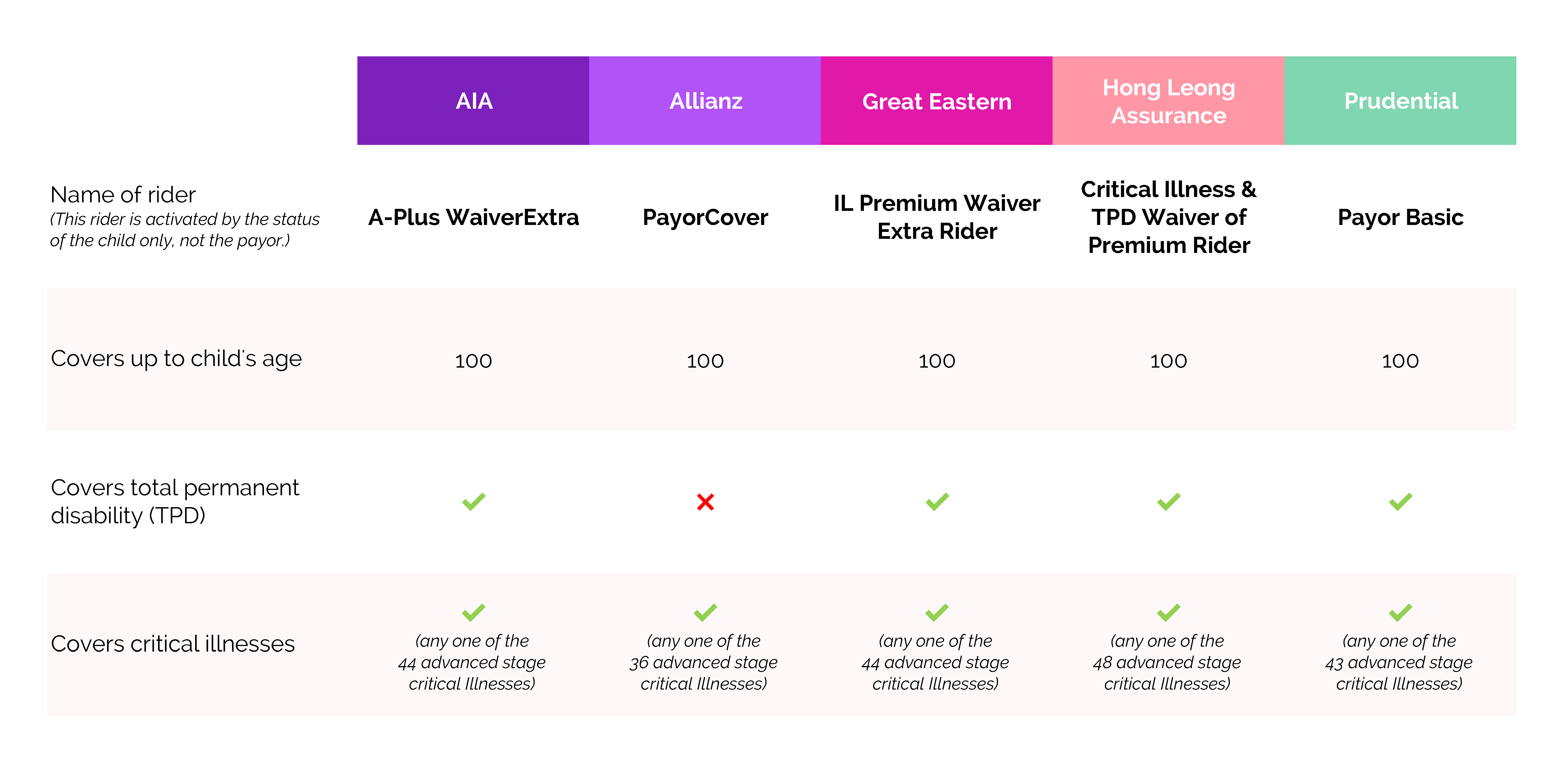

There are 2 premium waiver riders that I always recommend, for good reason.

One for if something happens to the payor of the insurance (usually that's you or your spouse).

Another for if something happens to your child.

Premium waiver riders are essential because they make sure the monthly premium will be waived (yes, get-insurance-for-free waived!) in the event of a misfortune in your family.

Premium waiver 1

Activated by status of Payor

With this rider in place, the monthly premium will be waived until your child turns at least 25 years old if the payor

- is diagnosed with a covered advanced stage critical illness

- OR becomes totally and permanently disabled (TPD)

- OR passes away.

Note that only 1 of the 5 companies we are discussing today extends this coverage to both parents, not just the payor.

Premium waiver 2

Activated by status of Child

This rider, on the other hand, will waive the monthly premium if the child

- is diagnosed with a covered advanced stage critical illness

- OR becomes totally and permanently disabled (TPD).

Waived until when?

Till the end of the coverage term, which is a duration you choose initially (before your insurance contract is in effect).

Typically the coverage term that you can choose is between 70 and 100 years old (age of your child).

When a tragedy happens in a family (e.g. critical illness, TPD or death), it is often a time when the household income is heavily reduced or even completely lost.

To then lose an insurance the family needed as a result of the loss of income would only make matters worse.

Which is why I think these 2 riders are so important.

A table below shows the names of the riders under each insurance company we highlighted in this article.

As well as a comparison of their specs.

2

Essential rider

Child-specific critical illness

This rider provides a lump sum payout if your child contracts any critical illness covered by your chosen insurance company.

Also worthy of note, as your child grows up, some insurers automatically convert this child-specific rider into an advanced stage critical illness rider for adults.

To determine how much coverage you would need, think about what new expense items you would have if your child were to be diagnosed with an illness or condition above.

Consider previously non-existent costs like these:

- costs of alternative treatments you might decide to get

- additional health supplements

- nursing care

- and even living expenses for yourself or your spouse if one of you were to quit your job to take care of the sick kid

- etc

3

Essential rider

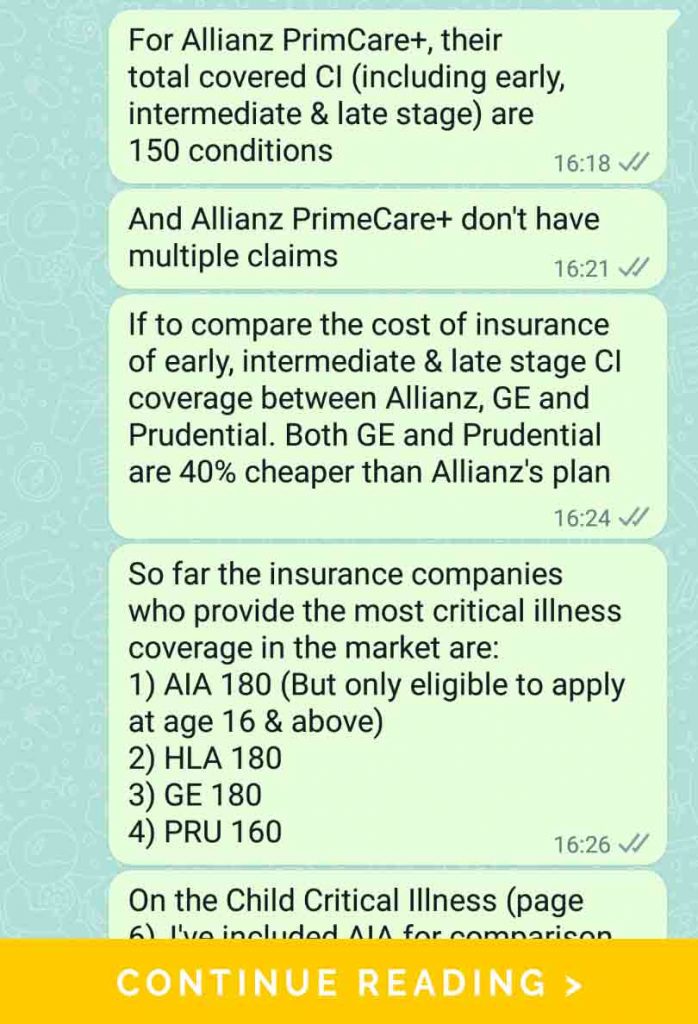

Early, intermediate and advanced stage critical illness

Unlike the previous rider, this rider covers all stages of critical illnesses.

As well as a good number of medical conditions and surgeries.

(Up to 180 conditions in total)

It's just not children-specific so it is largely different from the rider last mentioned.

Similarly, the payout is also in lump sum.

In terms of life stages this is good for, it can cover your child from birth to adulthood.

To apply the rider in a few examples:

- If the child gets early stage cancer, there will be a payout.

- If a second degree burn happens, there will be a payout.

- If the child requires an organ transplant, there will be a payout.

- etc

The list is so long (since it covers 180 items) I am unable to mention everything. But here's an overview of a summary and comparison of the 5 insurance brands.

There are 2 main reasons to consider this important rider.

Reason number ONE:

We may get diagnosed an illness before it gets advanced.

Compare ourselves now to our grandparents during their time.

The awareness of diseases are much higher today, thanks to public health campaigns like Breast Cancer Awareness Month and so on.

Collectively we also do a lot more health checks a lot more frequently.

Consequently, illnesses are discovered and diagnosed in their early stage more often today than in the past.

What used to happen when insurance companies only had advanced stage riders to offer was that... people could not claim a payout when they discovered their illness in its early stages!

Talk about double tragedy.

Reason number TWO:

We may experience more seasons of ill health in our now-longer lifespans.

On average we live about 6 years longer than the global population did 20 years ago. But not every additional year that we will live is necessarily a healthy one.

And this is where this early, intermediate and advanced stage critical illness rider comes in!

Only 3 out of the 5 insurers sell this rider, as shown in table above.

(Refer to the "Multiple claims" row.)

But this is an extremely important rider that gives you extra security and peace of mind...

Because it allows the insured person to make multiple claims if he/she happens to be diagnosed more than once with the same illness, or more than one illness listed above in a lifetime.

In many cases, the sum does not get reduced even after you get a payout (unlike most other critical illness insurances).

However, as with any insurance contract, there are terms & conditions to be applied.

Due to how extensive this 180-item rider is, you will benefit greatly from discussing the T&Cs with a professional.

What are some riders to avoid?

I err on the side of reservation with a few riders simply because there are better alternatives to secure the benefits they can provide.

These riders might surprise you because they are... surprisingly... quite popular!

I'm also going to provide alternative solutions that you can consider to replace these riders.

1

Non-essential rider

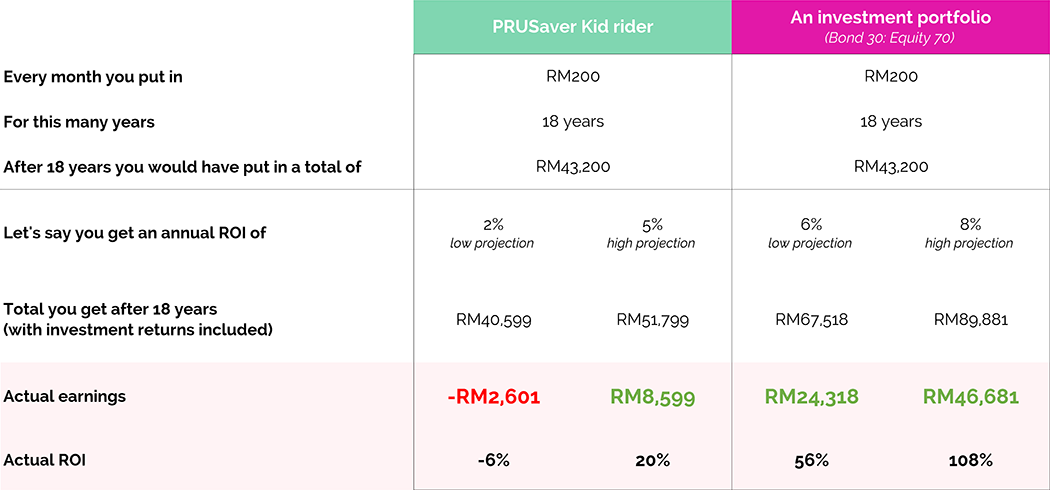

Investment rider to save up for an education fund

I love that most parent clients I have encountered are big on giving their children quality tertiary education.

So they do what they can to prioritise saving up for this huge expense down the line.

One of the very first steps a lot of them have taken is to get an investment rider—or a savings plan (also called an endowment plan)!

They have been told this would force them to put in some money every month.

Then, 18 years later, voila! The education fund is ready in full sum.

And the golden child is ready to run towards his megawatt-bright future to bring glory to the family name.

In reality how often does an investment rider or savings plan turn into a successful feelgood-movie ending like this?

Very rarely, unfortunately.

A simply better solution:

Separate your investments from insurances

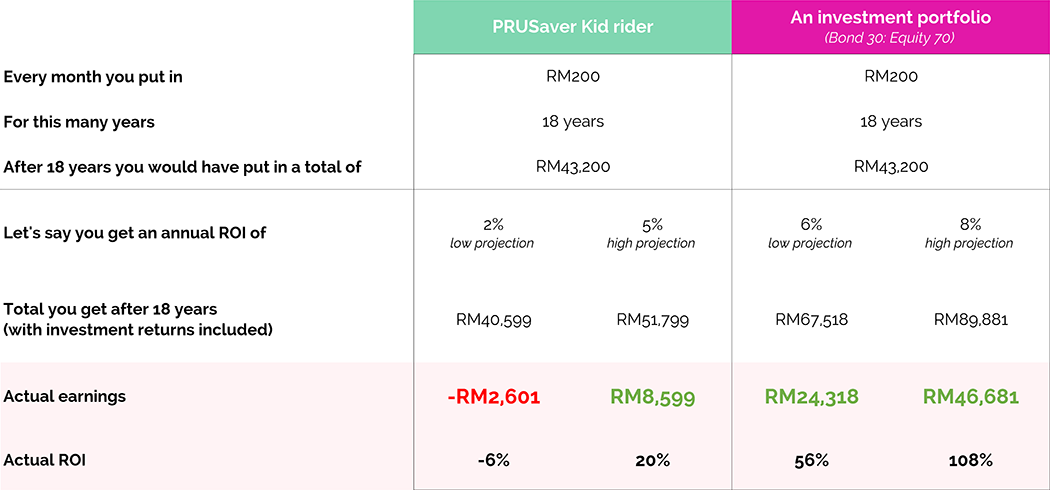

When you are investing for a goal as expensive as sending your baby to a reputable university in about 15 to 18 years from now...

Bear in mind the tertiary education industry boasts one of the highest inflation rates around.

About 8% every year.

To beat that, you need GREAT investment results.

And great investment results do not come from haphazardly mixing investments and insurances together or operating your investments with blind hope.

Among the 5 insurance companies we are discussing today, I've picked one with the best performing investment rider.

With two scenarios set up for each of them—one better and one worse—let's compare the investment rider against a moderately aggressive unit trust investment portfolio.

2

Non-essential rider

Personal accident (PA)

If you had taken out a RM1 million life insurance policy and were met with an accident resulting in the loss of one arm, you won't be paid any money.

Because a criterion for payouts is the loss of two limbs.

Personal accident insurances are the only insurance that provides coverage for partial disablement.

However, when you get it as a rider from life insurance companies the benefits are often slim.

(There are 2 overarching types of insurance companies, 1) life insurance companies and 2) general insurance companies.)

A simply better solution:

Getting the PA from a general insurance company

A great alternative is to get your personal accident insurance from a general insurance company.

The prices are around the same but the coverage is way better.

See this table below to compare the benefits and prices.

I'm using 2 companies from life insurers and 2 companies from general insurers as examples in the table.

Do you see?

Buying a PA plan from a general insurance company (instead of a life insurer) is a much more cost effective solution. Get PA quotations from general insurance companies.

What is the maximum I should spend on my child's medical card?

Getting the right insurances becomes immensely important as your responsibilities grow in life.

When you have made the right choices in your family insurance planning...

EVEN IF something happens to you, you can make sure that your family is going to be fine, financially at least.

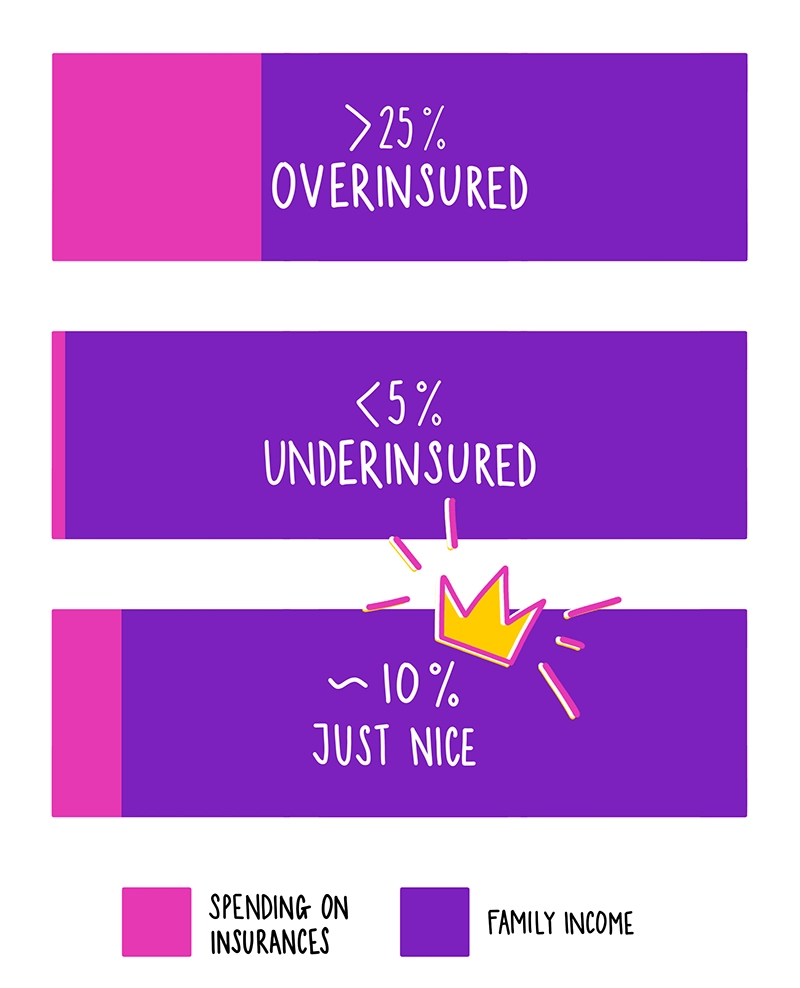

The general guideline for how much you should spend on insurances for the entire family is around 10%.

I'd say a child's medical card should take up between 1.5-3% of your household income, depending on what your current income level is.

If you're in doubt, feel free to book my time for a consultation.

Did you know?

Besides saving you time and energy that you would have lost otherwise, there is another inherent benefit of working with an LFP.

And it's the fact that our training and our job is to keep your overall financial health in mind; and we fully acknowledge the possibility of overspending on insurances.

As a Licensed Financial Planner, my goal will always be this—get you ONLY the necessary insurance your family needs.

So if you'd like to be neither overspending nor under-insured, let me help you get to the sweet spot.

Our clients have come back to us over and over again for different insurance needs because of how convenient our process is compared to the conventional way.

Conclusion

My team and I have poured our best efforts into this ultimate guide to help you protect your child's financial well-being.

Sincerely hoping this helps you out in one way or another.

We'd love to hear from you:

- Did you like this in-depth breakdown of children's medical cards?

- If yes, what is the biggest thing this has helped you with?

Leave a quick comment below to let us know!

Influence what we publish next:

Lady's Plan article, the 2nd most voted, has been published! Read it here.