So...

Somebody from either Prudential or AIA said you should get a Lady's Plan.

And everything about the product — the price, the benefits — all sound like a pretty good idea to you!

BUT you wouldn't be a wise consumer if you didn't do your due diligence and run a quick Google search to make sure the plan that you've been proposed is, in fact, the BEST option for you...

So here you are!

And you're in the right place because you're going to learn everything you need to know to make a sound decision on the Lady's Plan that you're considering, and more.

The WINNER: PRULady or A-Life Lady?

After a thorough comparison, my conclusion is that as of now PRULady is the better plan between the two.

However, this could very easily change in the future because insurance companies revise their plans all the time.

PRULady currently wins because:

- It is cheaper, goes as low as RM36 per month

- Also, it gives slightly more benefits, including a fantastic maturity benefit — a 100% refund

of all your premiums if you continue your policy until you are 69 years old!

Yep. You read that right.

This means the insurance product is practically giving you FREE female critical illness protection for life.

And the only way you can "lose out" is if you cancel this plan halfway.

On the other hand, the contender — AIA A-Life Lady — would be suitable for someone who wants a higher coverage because you can get insured for up to RM300,000 with AIA's Lady's Plan (instead of up to RM200,000 with PRULady).

What's more, it's also better for someone who prefers having this type of coverage for longer, until 80 years old (instead of 69 years old with PRULady).

While the maturity benefit AIA provides is very generous too, the maths work out better for people who are between 16 and 31 years old now.

Get An Expert's Help

with your Lady's Plan

Zero-obligation FREE quotations and expert consultation

by a Licensed Financial Planner

Hi, I'm Wei Chong!

A Licensed Financial Planner certified by Bank Negara Malaysia and Securities Commission.

My experience with Wei Chong was great, he is a professional financial advisor. Very helpful and understanding. He is not hard selling at all, no pressure meeting up with him. I would not hesitate to recommend him to anyone.

Professional, didn't push sales and he will come out few plan for us to consider. Wei Chong, thank you!

What is a Lady's Plan?

At this time there are more than 10 Lady's Plans offered by 11 insurance companies in Malaysia.

Lady's Plans are a type of insurance product that's marketed exclusively to ladies...

With a focus on risks and diseases females are especially prone to.

For example, tumors in female reproductive organs, cancers, a hysterectomy (surgery to remove a woman's uterus), a breast reconstruction surgery after having breast cancer, lupus with severe kidney damage, etc.

In addition to that, Lady's Plans also cover other female health risks that have nothing to do with female cancers.

Such as osteoporotic fracture, rheumatoid arthritis, and even pregnancy complications and/or a baby's birth defect.

Now that you understand what a Lady's Plan covers, know also that there are typically a range of amounts you can choose to be insured for.

From as low as RM5,000 to as high as RM300,000.

We call this your coverage amount or, more formally, your basic sum assured (BSA).

How do you use a Lady's Plan?

A Lady's Plan is very similar to a Critical Illness insurance plan.

Other names for a Critical Illness insurance include its acronym "CI", or in your native language you may have heard it being referred to as "36种疾病" or "36 penyakit kritikal".

Rings a bell?

If not, take a quick look at the main differences between the most common insurance, the medical card, versus CI and Lady's Plan.

You probably are more familiar with how insurance companies typically pay out to their medical card policyholders.

With a medical card, you get sick, get admitted to a hospital, then your hospitalisation costs will be taken care of by your insurance company.

Read our mega child medical card article to learn about medical cards in general.

(Although the title says it's for children, medical cards work exactly the same for adults and children. So the information within still applies to adults

With a Lady's Plan (and a CI plan) though, it's more like a Wheel of Fortune game you watched on TV as a child.

Except, in the context of insurance claims here, it's more like a wheel of mis-fortune...

In other words, how you would "use" a Lady's Plan is:

There is a long list of female critical illnesses and medical treatments that your Lady's Plan covers.

And if you get diagnosed with any of them, you'd get a 10%, 30%, 50% OR 100% payout.

(10%, 30%, 50% OR 100% of your coverage amount, that is.)

So if you purchased a RM25,000 coverage, your 50% payout would amount to RM12,500.

If you purchased a RM100,000 coverage, your 50% payout would be RM50,000.

So on and so forth.

Needless to say, whichever amount of coverage you decide to get — a minimum, average, or maximum — when you come across a time in your life that you're making an insurance claim... any extra cash that you get as a payout will come in super handy.

Let's run a claim scenario for better clarity, shall we?

CLAIM SCENARIO I

What you often hear these days is women finding lumps or a mass in their reproductive organ that their doctor says "is not cancerous now and hasn't spread but might become cancer in future".

Medically, that is called a female carcinoma-in-situ (CIS).

Other names for CIS include "stage zero cancer", "non-invasive cancer" and "precancerous cells".

Under either the PRULady or A-Life Lady plan, a female CIS diagnosis will get you a 50% payout.

And if it's straight up a malignant cancer (in a woman's reproductive organ), both plans offer a 100% payout.

Another possible claim scenario:

CLAIM SCENARIO II

Something that is much milder and has nothing to do with cancer, but it happens more as women age: osteoporotic fracture.

Meaning a bone fracture that happens when you strain, bump yourself or fall down while you're already suffering from osteoporosis (low bone density).

Both PRULady and A-Life Lady offer a 30% payout for an osteoporotic fracture.

As you read on, you will see a full list of female risks & diseases PRULady and A-Life Lady each covers.

As you read on, you will see a full list of female risks & diseases PRULady and A-Life Lady each covers.

Is there a best time to get a Lady's Plan? And when is it?

As soon as you can manage! There are three main reasons:

1. Free money to celebrate your milestones in life

I'm quite sure what first attracted you to consider a Lady's Plan are the Life Change Benefit (as Prudential calls it) or Cash Reward Benefit (as AIA calls it).

Essentially, if you get a Lady's Plan from either of these two insurance companies, you'll get financial rewards as you cross your big milestones in life (free cash, yay!).

For instance:

When you buy a new property you get money.

When you get married you get money.

When you give birth to a child you get money.

Very nice. I know.

There is a limit to how much in total you can get though (based on how much your coverage amount is).

Let's say your limit is RM4,500 with a PRULady RM50,000 coverage. Once you've gotten RM4,500, there's no more cash reward for you even if you hit a milestone again.

As you can see, if you purchased your Lady's Plan after you had already owned a property, got married and given birth to a child, you may have to wait until your retirement age (55 years old) to get the maximum x% of cash rewards.

Bear in mind also the waiting periods both Lady's Plans have in place. More on this later!

2. Premiums are lower when you start younger

This is simply a fact for any insurance under the sun.

The younger you are when you start an insurance, the lower your fees or premiums are.

Compare the monthly/annual premiums for different ages in this section of the article.

3. The only time you won't get denied for a purchase is while you are still healthy

If you wait until something has happened, such as a detection of a tumor, your chances of being denied for an insurance are very high.

If your doctor has confirmed a mass to be a carcinoma-in-situ or a malignant tumour/cancer, your application for a Lady's Plan will not go through.

The only time you can get an insurance is when you're healthy! So many of us often forget that.

PRULady vs A-Life Lady: Features Comparison

Both of these Lady's Plans provide an extensive list of coverages.

So we have quite a lot to go through.

But I've listed them this way to hopefully make the comparison clearer for you:

- Main covered events

- Female illness benefits

CORE

- Female recovery care benefits

- Female illness benefits

- Pregnancy Care Benefits

- Baby Care Benefits (if available)

SECONDARY

- Life change benefits

- Maturity benefit

BONUS

- Main covered events

- Female illness benefits

CORE

- Female recovery care benefits

- Female illness benefits

- Pregnancy care benefits

- Baby care benefits

SECONDARY

- Life change benefits

- Maturity benefit

BONUS

Now. Let's jump into a side-by-side features comparison of the two best Lady's Plans in Malaysia.

Prudential | AIA | |

|---|---|---|

Product name | PRULady | A-Life Lady |

Minimum coverage | RM25,000 | RM50,000 |

Maximum coverage | RM200,000 | RM300,000 |

Minimum entry age | 16 | 16 |

Maximum entry age | 44 | 45 |

Covers up to | 69 years old | 80 years old |

Main Covered Events The insurance policy will terminate after a claim in this category. | ||

Death or total permanent disability (TPD) | 100% payout | 100% payout |

Female cancer | 100% payout | 100% payout |

Systemic Lupus Erythematosus (SLE) with severe kidney complications | 100% payout | 100% payout |

Female Illness Benefits Maximum 1 carcinoma-in-situ claim. The claim will reduce your coverage amount until a reset happens. | ||

Carcinoma-in-situ (CIS) Breast, cervix uteri, uterus, fallopian tube, vulva/vagina or ovary | 50% payout | 50% payout |

Required time for a reset | 6 months after a CIS diagnosis | 12 months after a CIS diagnosis |

Female Recovery Care Benefits Maximum 2 claims in this category and only 1 claim per line item is allowed. | ||

Removal of female organs Breast, cervix uteri, uterus, fallopian tube, vulva/vagina or ovary | 30% payout | 30% payout |

Reconstructive surgery of female organs | 30% payout Breast(s) only | 30% payout Breast(s), cervix uteri or vulva/vagina |

Osteoporotic fracture | 30% payout | 30% payout |

Rheumatoid arthritis | 30% payout | 30% payout |

Facial reconstructive surgery due to cancer or accident | 30% payout | 30% payout |

Skin grafting due to skin cancer or accident | 30% payout | 30% payout |

Medical complication due to elective cosmetic surgery, menopause treatment or psychotherapy treatment | RM5,000 | |

Pregnancy Care Benefits Maximum 1 claim in this category for 10% payout. | ||

Abruptio placentae | ||

Acute fatty liver of pregnancy | ||

Amniotic fluid embolism | ||

Death of child | ||

Death of foetus | ||

Disseminated intravascular coagulation | ||

Eclampsia | ||

Ectopic pregnancy | ||

Hydatidiform mole | ||

Late miscarriage | ||

Molar pregnancy | ||

Placenta increta/percreta | ||

Baby Care Benefits Maximum 1 claim in this category for 10% payout. Prudential: until 50 years old | AIA: not applicable | ||

Atrial septal defect | ||

Cleft lip/palate | ||

Down's syndrome | ||

Patent ductus arteriosus | ||

Spina bifida | ||

Tetralogy of Fallot | ||

Transposition of the great vessels | ||

Ventricular septal defect | ||

Life Change Rewards | ||

Total life change rewards (%) | Up to 9% payout | Up to 12% payout |

Marriage | 3% payout | 3% payout |

Childbirth | 3% payout | 3% payout |

Buying a property | 3% payout | |

Retirement | 9% payout | 12% payout |

Death of spouse | 9% payout | |

Special Benefit | ||

Maturity benefit | 100% refund of total premiums, | 150% of coverage amount, paid out at age 80 |

Get our help with your Lady's Plan

Zero-obligation FREE quotations and expert consultation by a Licensed Financial Planner

How does a "Reset" in these Lady's Plans work?

Prudential calls it a "Bounce-back Feature"; AIA calls it a "Power Reset".

What they both refer to is a benefit that applies to reset the amount of payout that you can get after a female carcinoma-in-situ diagnosis.

Let's use another claim scenario to make this less confusing.

CLAIM SCENARIO III

Amanda who is a policyholder of a Prudential Lady's Plan gets diagnosed with a carcinoma-in-situ in one of her fallopian tubes.

Her Lady's Plan has a coverage amount of RM100,000.

With her female CIS diagnosis, she got a 50% payout (RM50,000).

So she has RM50,000 left in her Lady's Plan.

After 6 months from her diagnosis date, her RM50,000 coverage amount resets itself to become RM100,000 again! Hooray!

After the reset, while she cannot make a claim for another female CIS ever again, she will get the full 100% payout in the event that she... dies, or suffers from a total permanent disability, or a female cancer or lupus (i.e. any item from the Main Covered Events category).

AIA's A-Life Lady works the same way except AIA's will take 12 months after the diagnosis date to reset.

Waiting Periods between life change rewards

One thing that could prevent you from receiving the full amount of life change rewards sooner rather than later is the waiting periods set in place by the insurance companies.

PRULady vs A-Life Lady: How much do they cost?

See at a glance what your annual premium would be for different coverage amounts with a Prudential PRULady plan or AIA's A-Life Lady plan.

Naturally, the higher the coverage amount, the more expensive your premium would be.

Which coverage amount should you get?

Great question!

It would not be the most sound insurance strategy if you keep buying the wrong coverage amounts for your different insurances.

For every insurance type, be it a medical card, life insurance, critical illness plan, personal accident insurance or even a Lady's Plan, there is a way to calculate how much coverage amount is enough for you.

A few factors affect how much coverage you would need from a Lady's Plan, including:

- Do you already have a medical card, traditional Critical Illness (CI) plan or an early CI plan? And how much is the coverage amount?

- How much are your current monthly expenses?

- What kind of lifestyle change would you need if you get sick? And how much do they cost?

Admittedly, this exercise calls for a little bit of deep reflections on your part.

However, it is an important step not to be skipped. With everyone's individual preferences being so different, your answers will lead you to a number that can be vastly different from the next person's.

If you would like to discuss this with a Licensed Financial Planner who looks at insurances with a holistic approach (instead of only looking to sell even when the product doesn't suit you), I'd be happy to help.

Should you get a medical card or a Lady's Plan first?

If you don't already have a medical card, you should most definitely get a medical card first!

Why?

A medical card is more versatile than a CI or Lady's Plan, and can also be used to cover your costs if you need to be hospitalised due to a female critical illness.

If you have both a medical card and a Lady's Plan — and then let's say you get diagnosed with breast cancer — you would use your medical card to settle your hospital bills (including your surgery costs)...

AND use the payout from your Lady's Plan to cover many new expenses that follow any serious illness.

For example:

- Partial or complete loss of income

- Hiring help (because you might not be able to cook or clean while you heal!)

- Alternative treatments (Treatments such as acupuncture, massage therapy and other "non regular" therapies are not covered by medical cards.)

- A better health supplement regimen (to restore your health more effectively)

- etc

Get our help with your Lady's Plan

Zero-obligation FREE quotations and expert consultation by a Licensed Financial Planner

Should you spend your money on a Lady's Plan or invest the money instead?

If you wonder, "What if I just save up the monthly premium that I would be paying for a Lady's Plan and put them into an investment instead to be ready for a female critical illness?"

To answer that, we have to find out how long it would take you to achieve the sum of a coverage amount by investing your supposed Lady's Plan insurance premium.

Below I'll present the results of my simulation.

My personal conclusion:

A Lady's Plan is still worth considering even for a woman in her 40s who could achieve a sum of RM50,000 (in just 11 years) by saving up and investing about RM3000 every year.

Because in 11 years she would step into her 50s where the risks of female critical illness naturally increase.

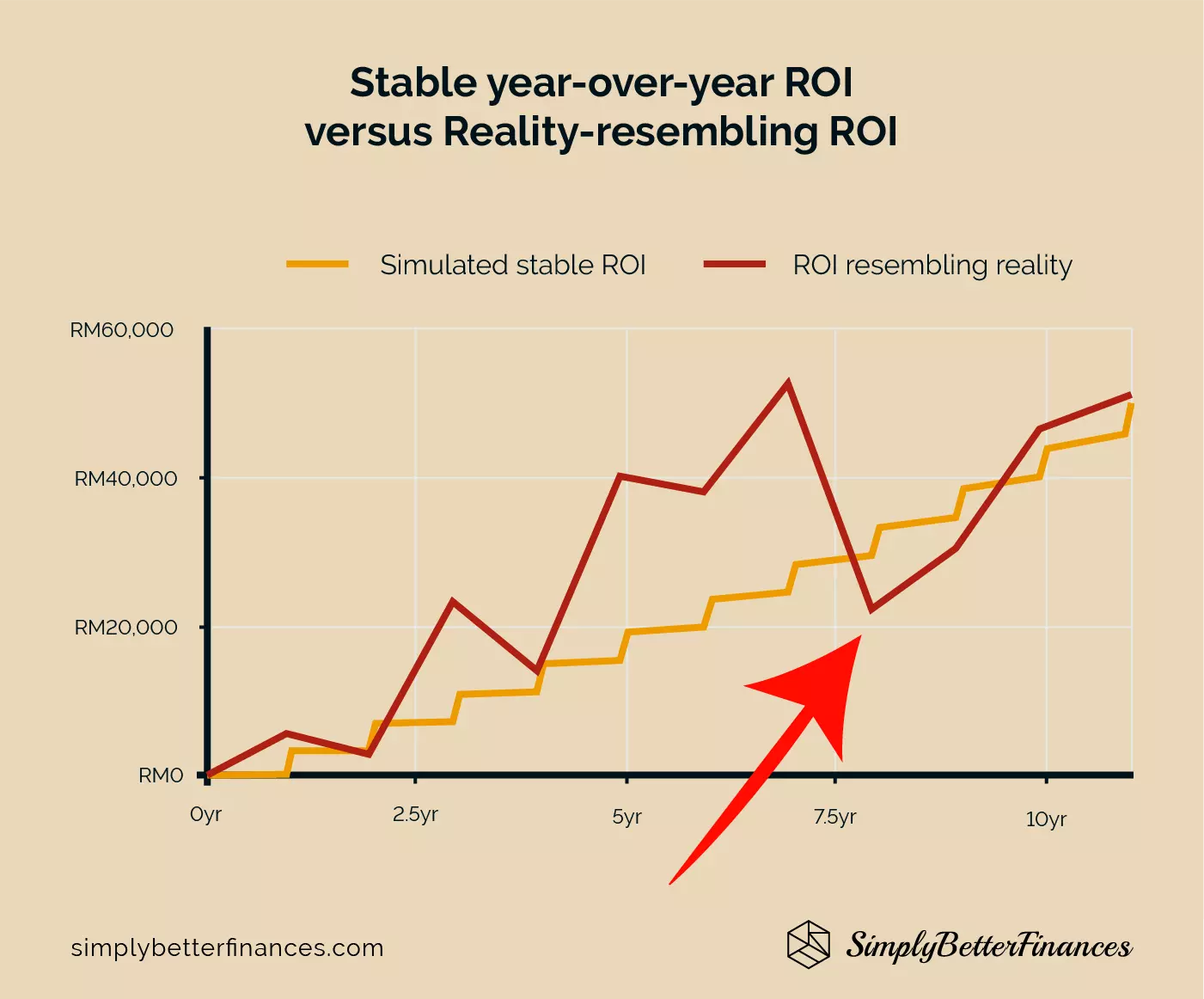

Also, to assume a stable year-over-year return of investment is typically being over-optimistic.

In reality investments go through an incredible number of ups and downs.

So if she got a female critical illness diagnosis during her, say, 8th year into this particular investing journey, she would have been better off getting a Lady's Plan that would give her a RM50,000 payout at any point of time in the chart below.

What do you think? What is your take?

Imo, the more reasons you have to be concerned with your female risks (maybe there are lots of female cancer cases in your family), the more you can justify choosing a female critical illness insurance over investing.

If you have a Lady's Plan, do you still need a pregnancy insurance, or vice versa?

There are areas of overlap between a Lady's Plan and a pregnancy insurance.

With that said, the biggest difference between them is what they prioritise.

Image extracted from pregnancy insurance article

A Lady's Plan provides more benefits for the mother/the woman.

Meanwhile, a pregnancy insurance focuses its benefits mainly on the baby.

Whether you need both or just one of them (or none!) highly depends on your needs, available budget and personal preferences.

Conclusion

A Lady's Plan can play an important role in a woman's insurance strategy.

Especially if a certain female critical illness runs in her family.

If your budget only allows you to choose between a medical insurance and a Lady's Plan, always choose to get a medical card first because it is more versatile.

Once you have decided that a Lady's Plan is a sound decision for you, get it sooner rather than later while you're still healthy.