I hope this article helps you out with your pregnancy insurance shopping!

If you want to save time and just get me to match you with 1–2 pregnancy plans that best suit your needs, click here.

I hope this article helps you out with pregnancy insurance shopping!

If you want to save time and just get me to match you with 1–2 pregnancy plans that best suit your needs, click here.

While researching and trying to learn about EVERY detail of your pregnancy you probably have come across one of these terms:

- Baby insurance

- pregnancy plan / pregnancy insurance

- maternity insurance

- or prenatal and postnatal insurance

(Industry professionals often call it "prenatal insurance")

It may have many names, but they all refer to the same thing:

An insurance product that protects you from losing money if something bad happens with your pregnancy or your baby.

For instance, when an expectant mother develops eclampsia...

Or when a miscarriage happens...

Or when baby is born with a disease or birth defect...

Just generally unfortunate situation that nobody wants to see happen. 🙁

OR it may even be something that is much less serious but still unwanted by parents, like these two:

- Jaundice (happens to more than 6 in 10 Malaysian babies!)

- Premature birth (happens 24.5% of the time and is more likely to cause the baby future health complications).

How Would a Pregnancy Insurance Help?

If you have a pregnancy insurance coverage during such unfortunate events, the insurance company will either compensate you with a lump sum of cash (up to RM10,000) OR they will pay off your hospital bills for you (up to RM30,000).

When we mention "baby insurance" in this article...

We are only talking about preborn or unborn babies here! If you're looking for an insurance for your baby who has been born... First of all, congratulations! 😀

A pregnancy insurance is no longer right for you. You should instead look into getting a Medical Card and (optionally) a Critical Illness plan for your baby.

Want my help to compare what's available on the market?

When we mention "baby insurance" in this article...

We are only talking about preborn or unborn babies here! If you're looking for an insurance for your baby who has been born... First of all, congratulations! 😀

A pregnancy insurance is no longer right for you. You should instead look into getting a Medical Card and (optionally) a Critical Illness plan for your baby.

Want my help to compare what's available on the market?

So Which Insurance Companies in Malaysia Provide Pregnancy Insurances?

If you are pregnant and living in Malaysia, you have 6 insurance companies to choose from for your pregnancy insurance:

- AIA

aia.com.my - Allianz

allianz.com.my - Great Eastern

greateasternlife.com - Hong Leong Assurance

hla.com.my - Manulife

manulife.com.my - Prudential

prudential.com.my

All of them happen to be big players in the industry.

More companies might start to offer this type of insurance in future.

When that happens I will make sure to update this article 🙂

Now.

If you wonder who offers THE BEST pregnancy insurance...

Honestly?

It really depends!

Because each brand has their own unique offering that makes them suitable for people with different concerns or priorities.

You'll see what this means soon as you read on.

What Are the Requirements for Getting a Pregnancy Insurance?

Perhaps you already knew this, but in case you didn't, here's a simple but important idea every insurance buyer needs to understand:

As you screen for qualified insurance plans from insurance companies...

THEY will also screen YOU to see if you are a healthy, eligible candidate.

As you screen for qualified insurance plans from insurance companies...

THEY will also screen YOU to see if you are a healthy, eligible candidate.

In fact, all insurance purchases work like this!

So here are the basic requirements you need to meet in order to begin getting a pregnancy insurance.

You are qualified to apply for a Pregnancy Insurance purchase if:

Special Cases

If You Are Having an IVF Baby or Twins!

Feel free to skip this section if it's not applicable to you.

Being pregnant as a result of an Assisted Reproductive Technology (ART) OR carrying more than one baby at a time poses more risks than a normal pregnancy does.

More risks = higher chances an insurance company needs to pay you an insurance claim.

Therefore, certain limitations are in place for pregnancy insurances offered to these groups.

With that said, there are still many great options available.

Choices for an IVF Pregnancy

As long as you're not carrying twins, triplets or more via an assisted reproductive treatment, all 6 insurers being discussed today accept IVF baby cases:

- AIA

- Allianz

- Great Eastern

- Hong Leong Assurance

- Manulife

- Prudential

They also accept cases of other assisted reproduction methods, such as ICI, IUI and others.

Insurers used to wait longer to take on IVF cases; today the requirements are a lot more favourable.

For instance, you can start getting insured as soon as you reach 13 weeks of pregnancy by Allianz and Manulife.

For AIA, Great Eastern, Hong Leong Assurance and Prudential, you can get a pregnancy insurance as soon as you reach 20 weeks of pregnancy.

Choices for a Twin Pregnancy

On the other hand, if you have naturally conceived twins, you have 5 insurance companies accepting twins' cases:

- AIA

- Allianz

- Great Eastern

- Manulife

- Prudential

A side note, it would be compulsory for you to purchase 2 plans, 1 for each twin if you decide to take up a pregnancy insurance.

Right now, there's not yet an insurer who is accepting triplets, quads or more.

If your pregnancy falls under one of these higher-risk groups, you are more prone to premature birth and other pregnancy complications.

For instance, it is incredibly common to deliver twins early (more than half of all twins are born prematurely), which qualifies for a premature birth claim payout.

So in a sense... you stand to benefit from a pregnancy insurance more than other people.

Especially if you haven't built up a sufficient emergency fund for your family just yet, and would like a backup plan for those unforeseeable costs...

(Or you just don't prefer spending your own cash on medical emergencies!)

What Exactly Does a Pregnancy Insurance Cover?

*Disclaimer: Some of these coverages are excluded by certain insurance companies. If you are comparing plans yourself with no help, please pay attention to what each plan includes and excludes! Or get my help here.

Coverage for the Mother

A pregnancy insurance protects a mother from a host of risks a woman may face while being pregnant and after giving birth, including:

Coverage for the Baby

A pregnancy insurance covers a multitude of risks and dangers a vulnerable baby may face after being born, including:

Also, Actually, the Pregnancy Insurance Coverage Is Not Available as a Single Product (It's an Add-on Feature!)

Meaning if you want to buy ONLY the "pregnancy insurance coverage" part, you cannot...

Because no Malaysian insurance company is selling it that way currently.

Instead:

A pregnancy insurance coverage must be attached to a Life Insurance for your baby.

With that said, since we are on the topic of insurance trivia......

Here's another piece of info that will help you be less confused about all kinds of insurances!

An add-on feature for an insurance is called a "Rider".

Therefore, strictly speaking, the pregnancy insurance coverage we have been discussing in this article is a Rider!

(And NOT an insurance product that can stand alone or be sold on its own.)

Understanding The Relationship Between an Insurance Plan and Its Riders

Fully understanding this part will help the rest of this article make more sense.

If you would imagine it, buying an insurance can be a little bit like getting ice cream!

You get your ice cream in a base flavour and you add on "toppings" to make it into whatever you prefer.

In this context, your baby's Life Insurance is the base flavour of your ice cream.

And the pregnancy coverage rider is one of the many toppings you can choose to get.

Base flavour = Life Insurance

Toppings = Pregnancy Coverage Rider, Medical Card Rider, Critical Illness Rider, etc

Base flavour = Life Insurance

Toppings = Pregnancy Coverage Rider,

Medical Card Rider, Critical Illness Rider, etc

For How Long Does This Insurance Protect You and Your Baby?

The function of the pregnancy rider we're talking about in this article is to protect you against risks that can take place while you are pregnant (hence the term "prenatal insurance" mentioned in the beginning)...

As well as after you have given birth (hence the term "postnatal insurance").

To break it down into clearer details, this is a typical timeline of a pregnancy insurance coverage:

The pregnancy insurance is a unique coverage that covers two lives — both the mother and the baby's — during the pregnancy and shortly after childbirth.

Which can be a form of convenience to a consumer like yourself.

Because it means there's no need to purchase separate insurances to protect both lives during the most crucial times of the maternity journey.

Another benefit that you can choose to tap into?

(As you've seen from the bottom of the timeline)

This insurance, with the help of a few other riders, has the potential to turn into a full-fledged health insurance for your child.

Enabling you to protect your child to the best of your abilities for the long term.

i.e. until he/she grows up more and not just until 5 years old.

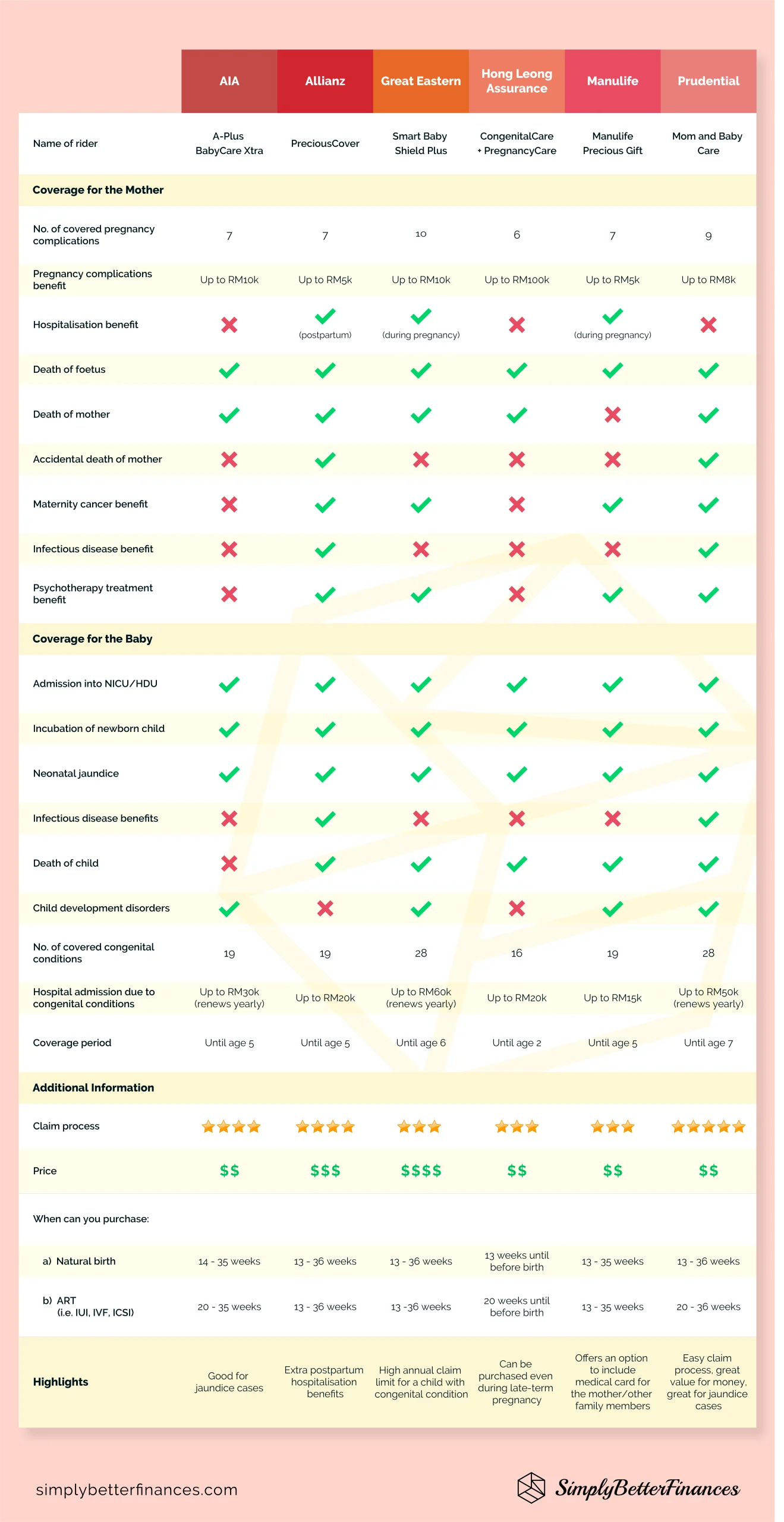

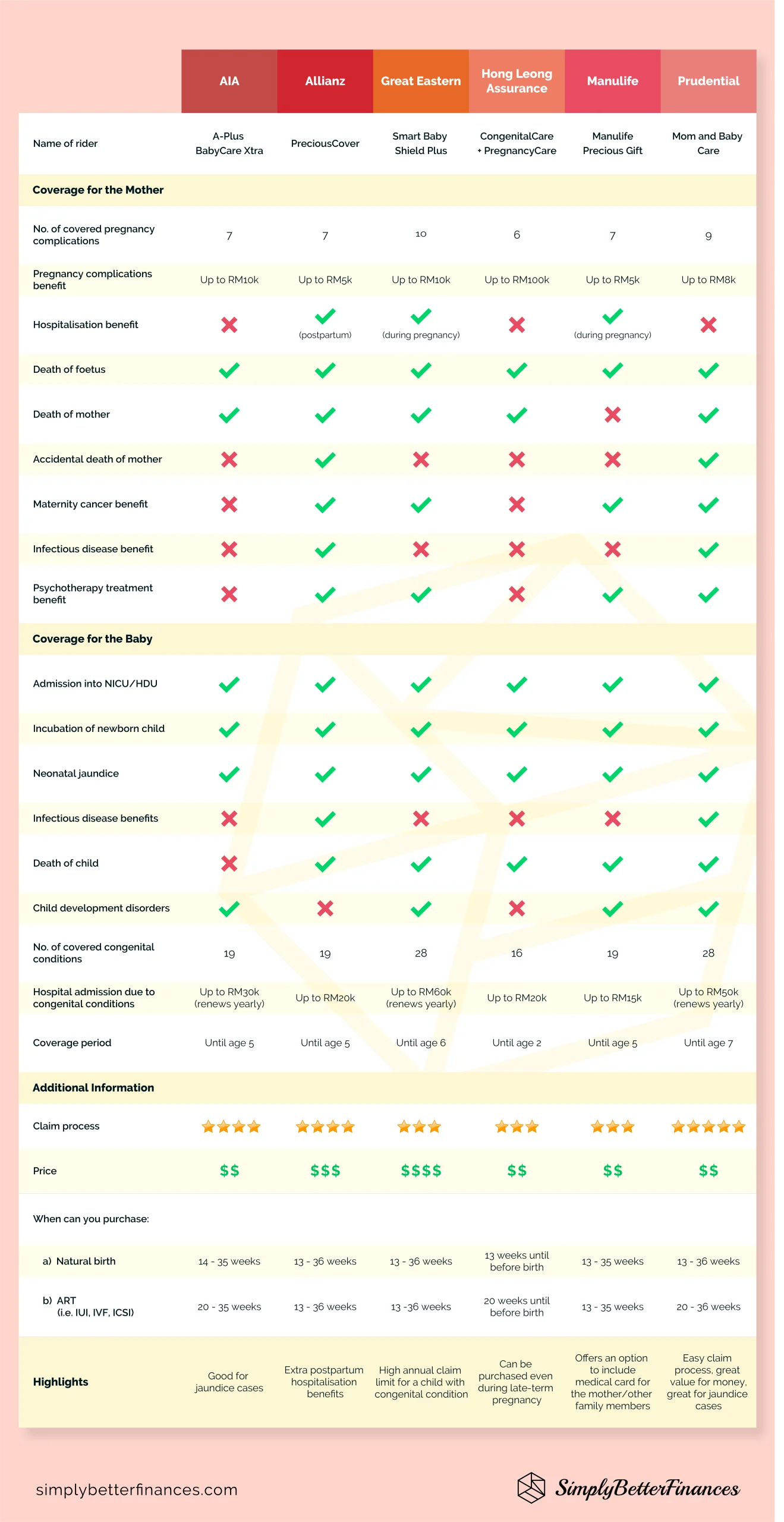

AIA, Allianz, Great Eastern, Hong Leong Assurance, Manulife, Prudential — How Do They Compare?

Now, let's talk about what you really came to find out.

This is how the 6 insurance companies stack up against each other in their pregnancy coverage rider:

AIA | Allianz | Great Eastern | Hong Leong Assurance | Manulife | Prudential | |

|---|---|---|---|---|---|---|

Name of rider | A-Plus BabyCare Xtra | PreciousCover | Smart Baby Shield Plus | CongenitalCare | Manulife Precious Gift | Mom and Baby Care |

Coverage for the Mother | ||||||

No. of covered pregnancy complications | ||||||

Pregnancy complications benefit | Up to RM10k | Up to RM5k | Up to RM10k | Up to RM100k | Up to RM5k | Up to RM8k |

Hospitalisation benefit | (postpartum) | (during pregnancy) | (during pregnancy) | |||

Death of foetus | ||||||

Death of mother | ||||||

Accidental death of mother | ||||||

Maternity cancer benefit | ||||||

Infectious disease benefit | ||||||

Psychotherapy treatment benefit | ||||||

Coverage for the Baby | ||||||

Admission into NICU/HDU | ||||||

Incubation of newborn child | ||||||

Neonatal jaundice | ||||||

Infectious disease benefits | ||||||

Death of child | ||||||

Child development disorders | ||||||

No. of covered congenital conditions | ||||||

Hospital admission due to congenital conditions | Up to RM30k | Up to RM20k | Up to RM60k | Up to RM20k | Up to RM15k | Up to RM50k |

Coverage period | Until age 5 | Until age 5 | Until age 6 | Until age 2 | Until age 5 | Until age 7 |

Additional Information | ||||||

Claim process | ||||||

Price | $$ | $$$ | $$$$ | $$ | $$ | $$ |

When can you purchase: | ||||||

a) Natural birth | 14 - 35 weeks | 13 - 36 weeks | 13 - 36 weeks | 13 weeks until before birth | 13 - 35 weeks | 13 - 36 weeks |

b) ART | 20 - 35 weeks | 13 - 36 weeks | 20 - 36 weeks | 20 weeks until before birth | 13 - 35 weeks | 20 - 36 weeks |

Highlights | Good for jaundice cases | Extra postpartum hospitalisation benefits | High annual claim limit for a child with congenital condition | Can be purchased even during late-term pregnancy | Offers an option to include medical card for the mother/other family members | Easy claim process, great value for money, |

Have you noticed?

Each company's pregnancy insurance coverage has its strengths and weaknesses!

So how you can go about this yourself is:

Step 1

Determine a budget range that you are ready to fork out every month.

Step 2

Start asking around for quotations from insurance agents from different companies to find the best plan with the most benefits that fits within the budget that you've set in Step 1.

OR, if you hate wasting time to do this yourself, or maybe you just dread meeting and turning down insurance agents...

The simply better way is to get help from a Licensed Financial Planner (LFP) like myself who has access to multiple insurance companies.

Yes, Multiple.

More than one.

You read that right.

As a Licensed Financial Planner, I propose and sell insurances of all types, and of almost every brand in Malaysia (total 14 brands now).

Including the six we are discussing today (AIA, Allianz, Great Eastern, Hong Leong Assurance, Manulife, Prudential).

For each client, I generate quotations from multiple insurers.

Then, I help my clients filter out plans that are not as good, or as cost-efficient, or as complete.

Hence the ability to find the best plan on the market that suits your specific needs and lifestyle.

The real beauty of this for my clients?

They save so much time and headache from not having to face several agents, hold several meetings, and collect quotations from several sources...

They get the best plan possible for their needs.

And they stay within their budget...

Allll WITHOUT paying a single cent more than if they had gone through the process by themselves with different agents.

An LFP like myself also comes in extra handy if your intention is to find a full-fledged, long-term health insurance for your child.

You know, like I mentioned above.

Reason being, there will be TOO. MANY. DARN. RIDERS to consider and compare.

(Imagine comparing ALL the plans by yourself, among different brands, with different combo of riders, all at different price points.)

...having the help of someone knowledgeable and professional can be a great relief. Especially someone who already has a lot of experience dealing with pregnancy insurances.

*Cue your own slow smile while you let out a huge breath?* 😉

Free Insurance Consultation with a Pregnancy Plans Expert

Get your no-obligation, FREE expert consultation. Where we'll take you through the best pregnancy plans for YOU that's on the market now. This is the new and improved way to source an insurance — smart, unbiased and ultra efficient.

Follow these Steps

1. Complete the questionnaire above

What you submit is info we will need to make your quotations and a personalised report.

2. Book a time

Make sure you book a time for your online appointment with our licensed expert.

3. Sit back and relax

That's it! You are now in great hands of a team who will find the perfect plan for you. On the day of your appointment, just show up on time and be ready for the best insurance experience ever!

what my clients say

My experience with Wei Chong was great, he is a professional financial advisor. Very helpful and understanding. He is not hard selling at all, no pressure meeting up with him. I would not hesitate to recommend him to anyone.

Kar Poh

Professional, didnt push sales and he will come out few plan for us to consider. Wei Chong, thank you!

Vicky Liew

Wei Chong is a professional financial adviser that listened to our requirements. He listed down the pros and cons of the insurance plans and guided us to choose the most suitable one.

Sok Yi

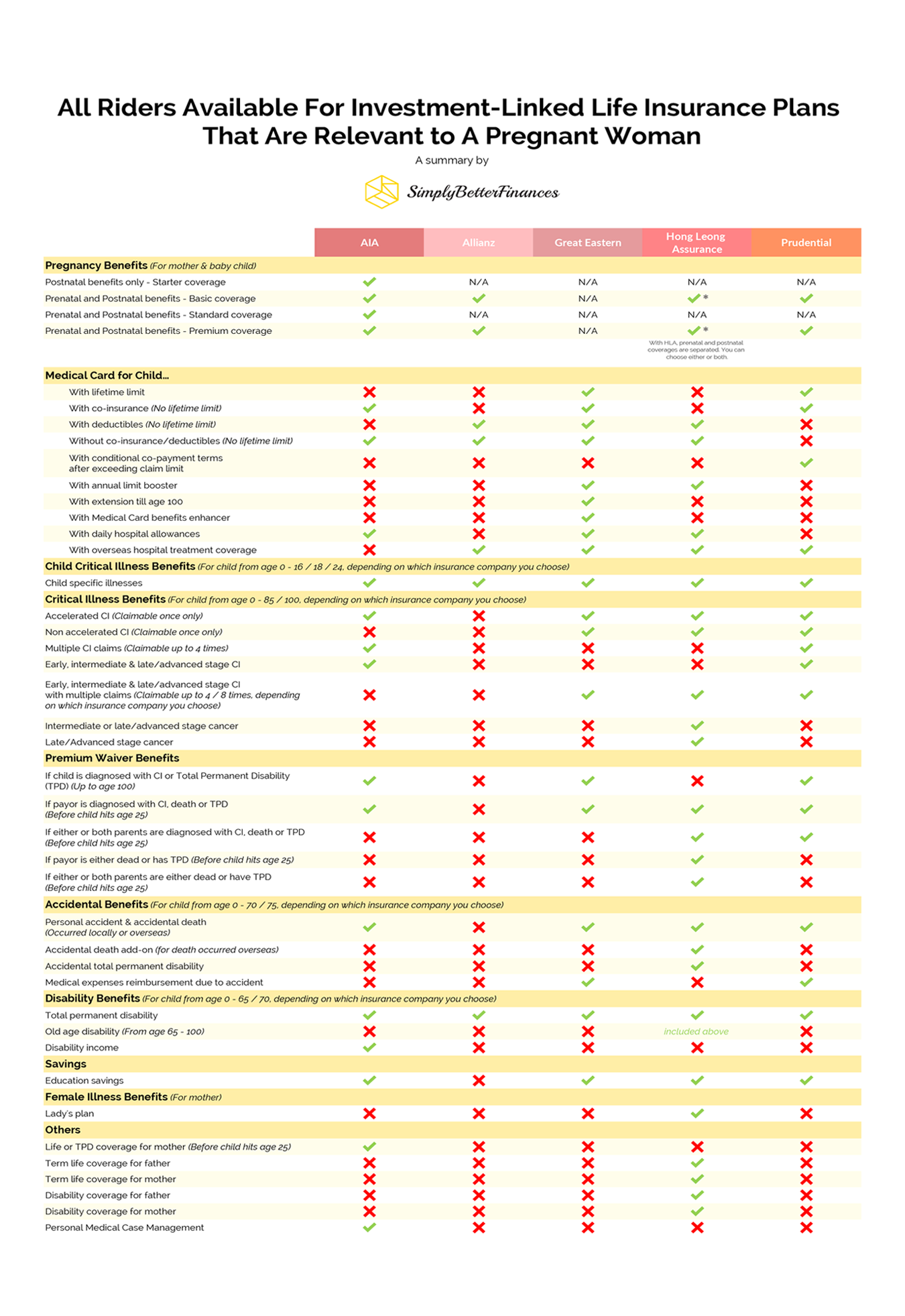

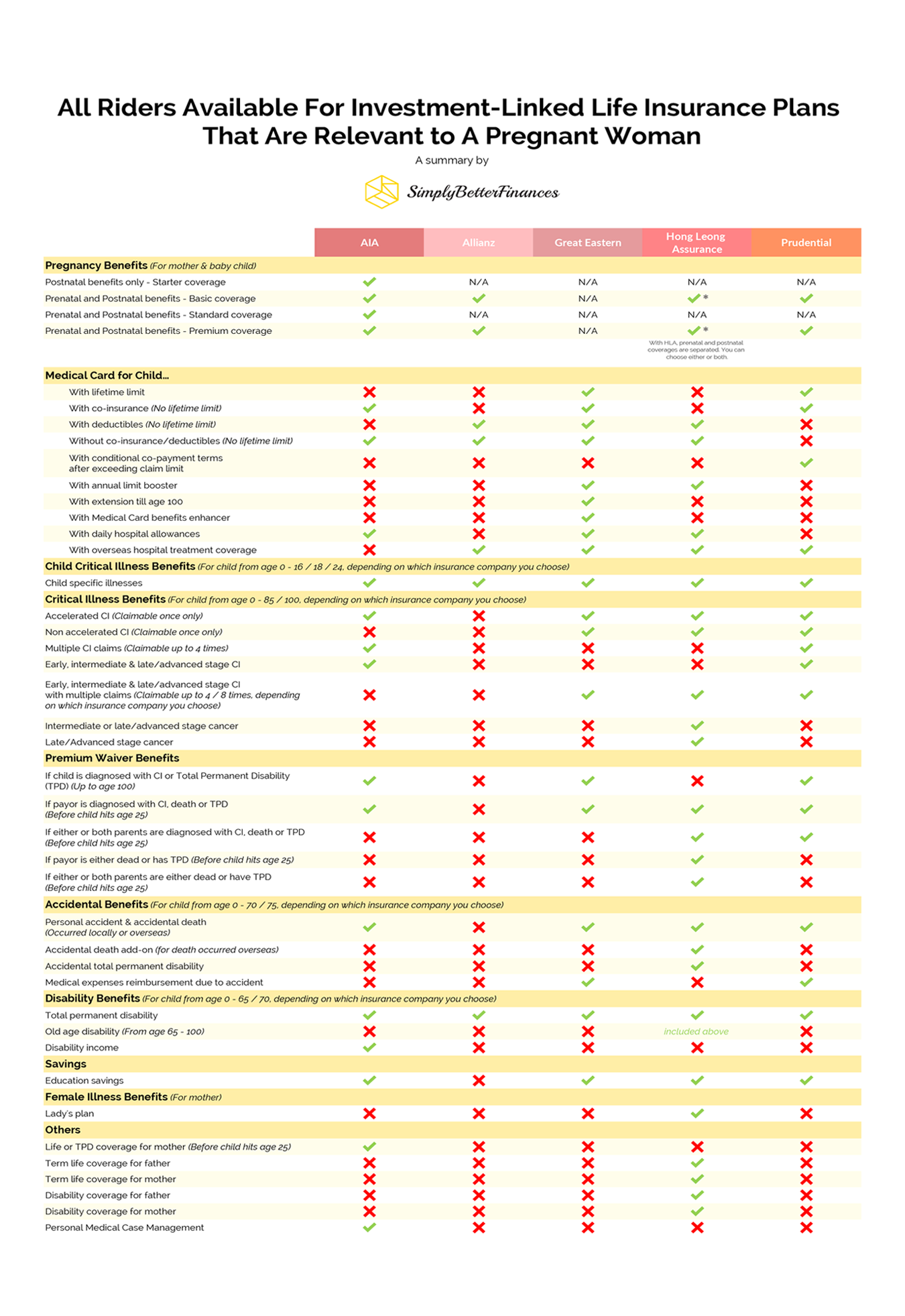

Speaking of Too Many Riders, What Other Riders Are Available? Should You Get Them?

Almost every kind of insurance nowadays comes with a looong list of riders that you can pick and choose from to beef up the insurance policy.

Riders make a basic insurance plan stronger, and offer even more, even wider or even better protection.

The same applies to the pregnancy/life insurance we are talking about today.

If you're planning to go the DIY-meet-many-agents route, I want to be helpful to you too.

Below here I have a *painstakingly* prepared list of Riders that you can consider to go together with your baby's Life Insurance + pregnancy insurance rider.

Compiled in 2021, there were only five insurance brands offering pregnancy insurances.

Since then there have been minor changes and additions that have not been included in the list.

Some Riders in here can provide your family immense value, so they are worth some serious consideration.

The rest may not necessarily benefit you any further than the protection you are already getting. They would just be fluff that ends up costing you a little more every month.

If you're feeling dizzy after viewing the Riders list, fret not.

An experienced insurance rep should be able to recommend the right Riders for you to consider after listening to your specific needs and concerns.

When you talk to your rep, feel free to ask questions.

Make sure you understand what you're buying.

And, do not be afraid to request adjustments to your quotation to make sure the final costs fit into your budget.

Last but not least, most people do not know this but:

Even after you have bought an insurance, you can always contact your agent to add on additional rider(s) later.

Be it a few months or years from now.

-- I hope these insurance tips help!

Can One of Those "Lady's Plans" on the Market Substitute Your Baby's Life Insurance + Pregnancy Coverage Rider?

So I've helped you understand that you can get pregnancy insurance coverage together with a Life Insurance for your baby.

Alternatively?

Yes, it's true that you CAN also get some of these maternity benefits from certain Lady's plans on our Malaysian market.

If you have to compare the two:

The main difference between them is their focal point.

One focuses on the mother more; the other focuses on the baby more.

Keep an eye out for a detailed breakdown of "Lady's Plan vs Pregnancy Insurance" in a future article.

Whew, I know this is A LOT to digest!

However, if by now you have understood

- What a pregnancy insurance is,

- How it could potentially benefit you,

- And how you may use riders to get more out of the insurance...

But you still wonder how to decide whether YOU should actually get one?

Since every family's needs are different, right?

An Easy Way To Tell if a Pregnancy Insurance Will Benefit You (or Be a Complete Waste of Your Money!)

a Pregnancy insurance can benefit you if

The Goal is to Avoid Scenarios like these

Something bad happens... The safety of your pregnancy or your child is endangered, you (of course) want to get whatever medical treatments, medications or, if need be, even surgeries... whatever is necessary at this point....

Conclusion

That's it for my guide to getting the best pregnancy insurance in Malaysia.

Now I'd like to hear from you:

What information from this article was new to you?

Or maybe you have a specific question about your pregnancy/pregnancy insurance.

Either way, leave a quick comment below to let me know.

Influence what we publish next:

Lady's Plan article, the 2nd most voted, has been published! Read it here.

Hi I came across this detailed sharing on different pregnancy insurance of yours and it’s very helpful. Thanks for your effort and the beautiful section/layout/comparison of the graph/table to help general people like us to understand more.

Hi Janice, your comment made our day! SO glad to hear this was helpful 😀

Are you currently pregnant or have you given birth? Either way, YEAY and congratulations!! 🥳🥳

I’m glad I come across your website

thank you for spreading this awareness

May you gain heaps of rewards!

I appreciate your comment Sha! 🙂